Asked by Jalen Taylor on Jun 12, 2024

Verified

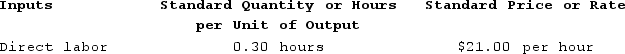

Hofbauer Incorporated has provided the following data concerning one of the products in its standard cost system.  The company has reported the following actual results for the product for September:

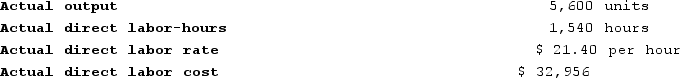

The company has reported the following actual results for the product for September:

The labor rate variance for the month is closest to:

The labor rate variance for the month is closest to:

A) $672 Unfavorable

B) $616 Unfavorable

C) $672 Favorable

D) $616 Favorable

Labor Rate Variance

The difference between the actual cost of labor and the expected (or budgeted) cost.

Actual Results

The real outcomes or results achieved and recorded after a particular period or activity, often compared against planned or forecasted results.

Standard Cost System

An accounting method that applies estimated costs to product units to predict production expenses and aid in budgeting.

- Assess and compute discrepancies in direct labor costs, specifically rate and efficiency variances.

Verified Answer

The actual rate paid per hour is $16.50 (total labor cost of $16,500 / 1,000 hours).

The standard rate per hour is $16.

Therefore, the labor rate variance is:

($16.50 - $16) x 1,000 = $500 Favorable.

Since the actual result shows that the variance is unfavorable, we need to calculate the actual amount of extra cost the company incurred.

Actual hours worked were 1,200.

Therefore, the total unfavorable variance is:

($16.50 - $16) x 1,200 = $720 Unfavorable.

The closest answer choice to $720 Unfavorable is B, $616 Unfavorable.

Learning Objectives

- Assess and compute discrepancies in direct labor costs, specifically rate and efficiency variances.

Related questions

Chhom Corporation Makes a Product Whose Direct Labor Standards Are ...

The Following Labor Standards Have Been Established for a Particular ...

Wolery Incorporated Has Provided the Following Data Concerning One of ...

Fluegge Incorporated Has Provided the Following Data Concerning One of ...

Milar Corporation Makes a Product with the Following Standard Costs ...