Asked by Alicja Gawlik on Jul 22, 2024

Verified

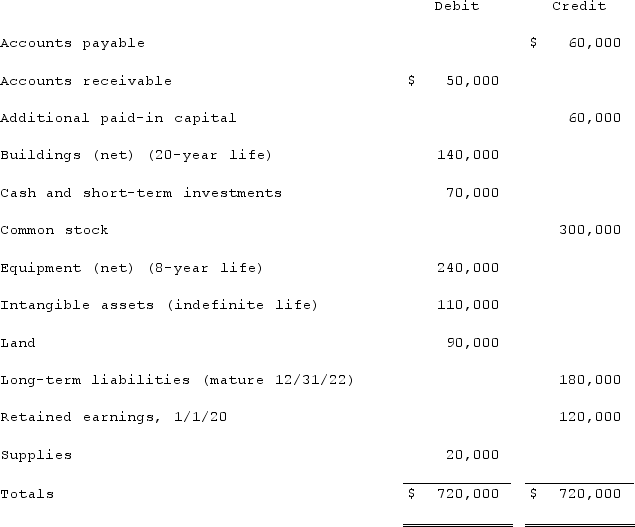

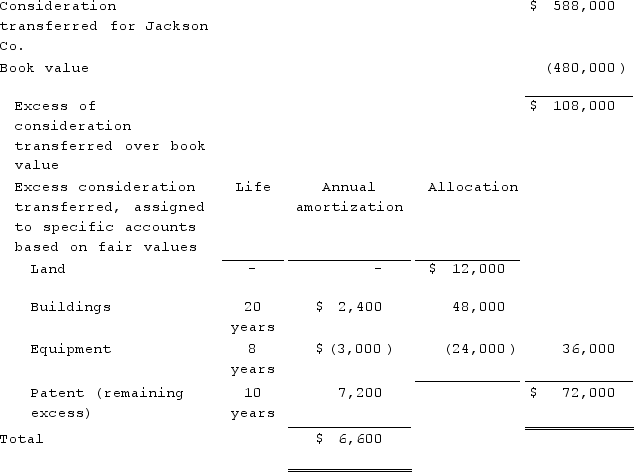

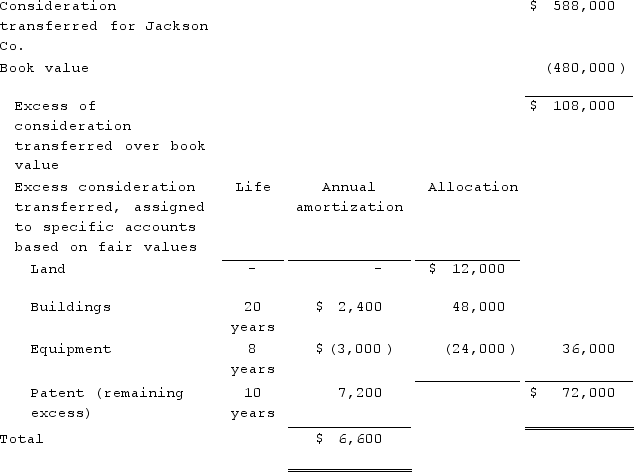

Matthews Co. acquired all of the common stock of Jackson Co. on January 1, 2020. As of that date, Jackson had the following trial balance:  During 2020, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2021, Jackson reported net income of $132,000 while paying dividends of $36,000. Assume that Matthews Co. acquired the common stock of Jackson Co. for $588,000 in cash. As of January 1, 2020, Jackson's land had a fair value of $102,000, its buildings were valued at $188,000, and its equipment was appraised at $216,000. Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years.Matthews decided to use the equity method for this investment.Required:(A.) Prepare consolidation worksheet entries for December 31, 2020.(B.) Prepare consolidation worksheet entries for December 31, 2021.

During 2020, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2021, Jackson reported net income of $132,000 while paying dividends of $36,000. Assume that Matthews Co. acquired the common stock of Jackson Co. for $588,000 in cash. As of January 1, 2020, Jackson's land had a fair value of $102,000, its buildings were valued at $188,000, and its equipment was appraised at $216,000. Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years.Matthews decided to use the equity method for this investment.Required:(A.) Prepare consolidation worksheet entries for December 31, 2020.(B.) Prepare consolidation worksheet entries for December 31, 2021.

Equity Method

An accounting technique used for recording investments in associate companies where the investment is initially recorded at cost and subsequently adjusted for the investor’s share of the net profits or losses of the investee.

Consolidation Worksheet Entries

Journal entries used in preparing consolidated financial statements, helping to adjust and eliminate internal transactions between parent and subsidiary entities.

Fair Value

An estimate of the price at which an asset or liability could be exchanged in a current transaction between willing parties.

- Explain the methodology and arithmetic required for compiling consolidation spreadsheets after a takeover.

- Execute and account for the division of purchase expense, factoring in corrections to the fair values of both assets and liabilities.

Verified Answer

LN

Logan NovelloJul 27, 2024

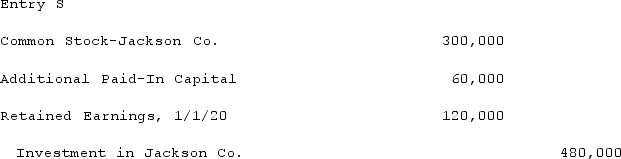

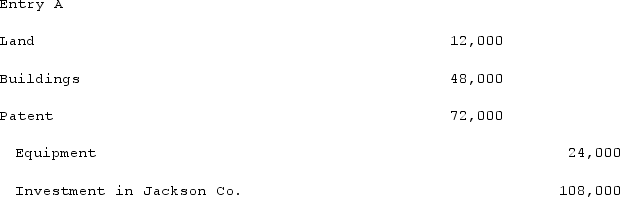

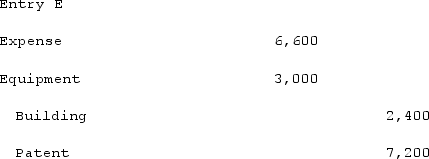

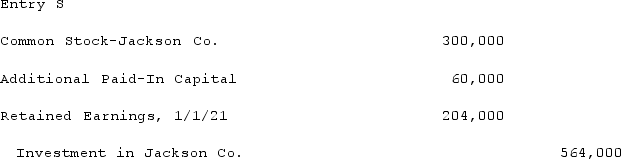

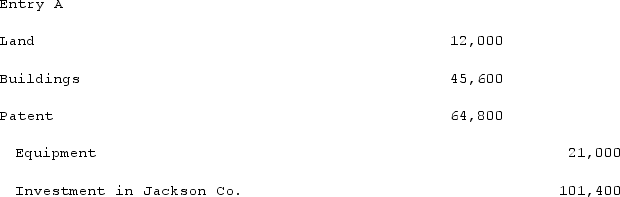

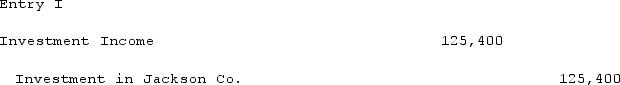

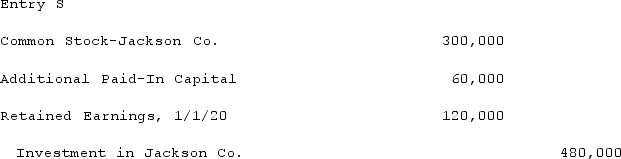

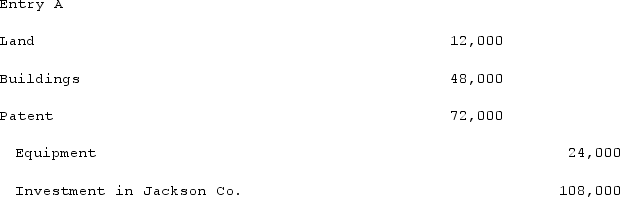

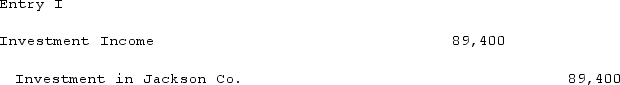

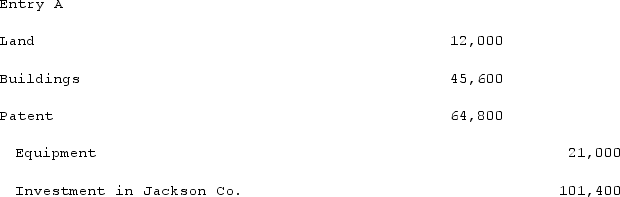

Final Answer :  A.Consolidated Worksheet Entries-2020:

A.Consolidated Worksheet Entries-2020:

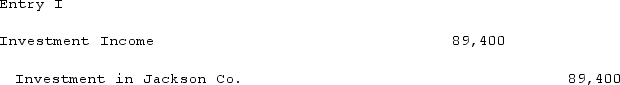

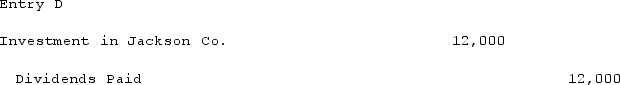

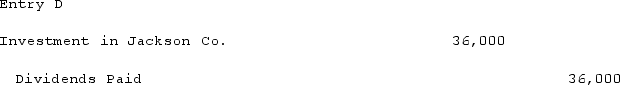

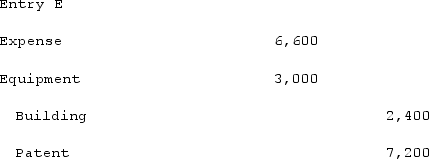

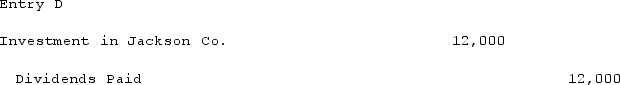

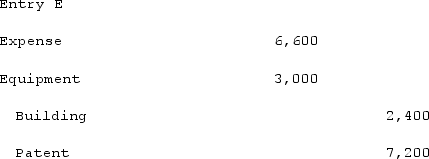

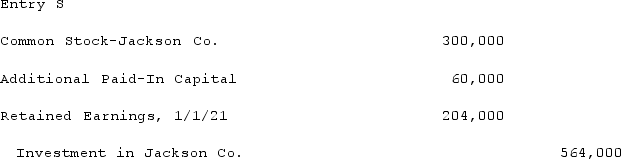

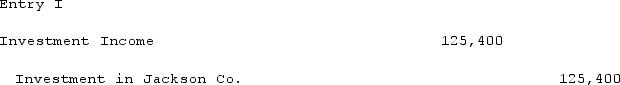

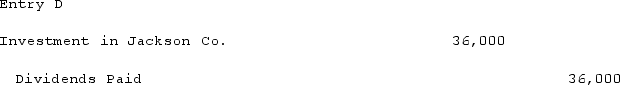

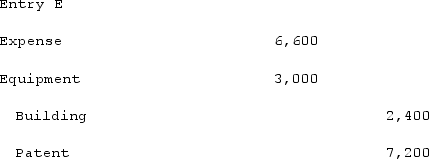

B.Consolidated Worksheet Entries-2021:

B.Consolidated Worksheet Entries-2021:

A.Consolidated Worksheet Entries-2020:

A.Consolidated Worksheet Entries-2020:

B.Consolidated Worksheet Entries-2021:

B.Consolidated Worksheet Entries-2021:

Learning Objectives

- Explain the methodology and arithmetic required for compiling consolidation spreadsheets after a takeover.

- Execute and account for the division of purchase expense, factoring in corrections to the fair values of both assets and liabilities.