Asked by Arcie Robyn on Apr 25, 2024

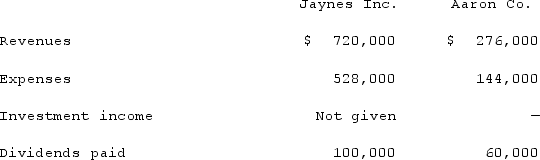

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2020, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities acquired is assigned to an unrecorded patent to be amortized over ten years.The following figures came from the individual accounting records of these two companies as of December 31, 2020:  The following figures came from the individual accounting records of these two companies as of December 31, 2021:

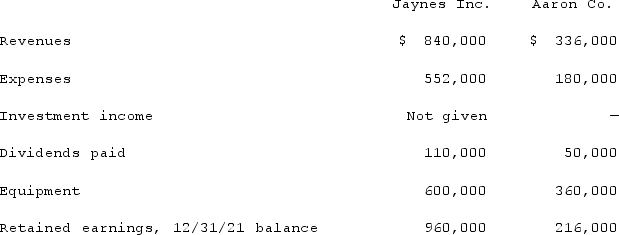

The following figures came from the individual accounting records of these two companies as of December 31, 2021:  What was consolidated net income for the year ended December 31, 2021?

What was consolidated net income for the year ended December 31, 2021?

Equity Method

An accounting technique used by a company to record its investment in another company when it holds significant influence but not full control.

Amortization

The gradual reduction of a debt over a period of time through regular payments that cover both principal and interest.

Net Book Value

The total value of a company's assets minus its liabilities and intangible assets, indicating the net worth of the company's tangible assets.

- Outline the procedures and numerical operations necessary for designing consolidation tables in the aftermath of an acquisition.

- Familiarize oneself with the equity accounting technique for investments and its impact on the amalgamation of financial statements.

Learning Objectives

- Outline the procedures and numerical operations necessary for designing consolidation tables in the aftermath of an acquisition.

- Familiarize oneself with the equity accounting technique for investments and its impact on the amalgamation of financial statements.