Asked by ?ông Ngô Trinh on Jul 04, 2024

Verified

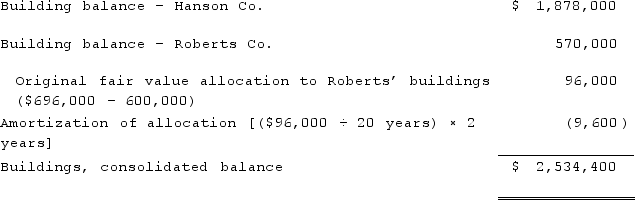

Hanson Co. acquired all of the common stock of Roberts Inc. on January 1, 2020, transferring consideration in an amount slightly more than the fair value of Roberts' net assets. At that time, Roberts had buildings with a twenty-year useful life, a book value of $600,000, and a fair value of $696,000. On December 31, 2021, Roberts had buildings with a book value of $570,000 and a fair value of $648,000. On that date, Hanson had buildings with a book value of $1,878,000 and a fair value of $2,160,000.Required:What amount should be shown for buildings on the consolidated balance sheet dated December 31, 2021?

Consolidated Balance Sheet

A consolidated balance sheet combines the financial statements of a parent company and its subsidiaries into a single document, showing the total assets, liabilities, and equity of the consolidated entity.

Fair Value

The estimated market price of an asset or liability, reflecting what a willing buyer would pay a willing seller in an arm's length transaction.

Useful Life

Useful Life is the estimated period that an asset is expected to be productive or provide benefits to a business, determining its depreciation or amortization schedules.

- Detail the steps and calculations essential for the creation of consolidation worksheets post-acquisition.

- Assess and account for the breakdown of the purchase amount, including revisions to the fair values of assets and liabilities.

Verified Answer

SB

Learning Objectives

- Detail the steps and calculations essential for the creation of consolidation worksheets post-acquisition.

- Assess and account for the breakdown of the purchase amount, including revisions to the fair values of assets and liabilities.