Asked by Jasmyne Daise on May 29, 2024

Verified

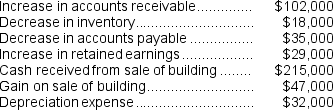

Majorn Auto Parts Store had net income of $81,000 for the year just ended.Majorn collected the following additional information to prepare its statement of cash flows for the year:  Majorn uses the indirect method to prepare its statement of cash flows.What is Majorn's net cash provided by (used in) operating activities?

Majorn uses the indirect method to prepare its statement of cash flows.What is Majorn's net cash provided by (used in) operating activities?

A) $41,000

B) $(53,000)

C) $185,000

D) $279,000

Indirect Method

A method used in cash flow statements to adjust net income for the changes in non-cash accounts to arrive at operating cash flow.

Net Income

The total profit of a company after all expenses, taxes, and costs have been subtracted from total revenue.

Operating Activities

The day-to-day actions that involve the production, sales, and delivery of a company's product or service, as reflected in its income statement.

- Assess the net cash contribution from (or requirement for) operating activities.

Verified Answer

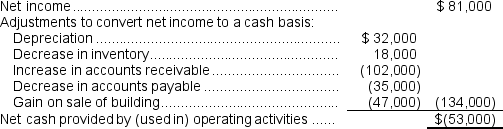

Net income: $81,000

Depreciation expense: $135,000

Gain on sale of equipment: $(15,000)

Increase in accounts receivable: $(20,000)

Decrease in inventory: $7,000

Increase in accounts payable: $(70,000)

Net cash provided by (used in) operating activities = Net income + Depreciation expense + Gain on sale of equipment +/- Changes in current assets and liabilities

= $81,000 + $135,000 - $15,000 - $20,000 + $7,000 - $70,000

= $(53,000)

Therefore, the best choice is B.

Learning Objectives

- Assess the net cash contribution from (or requirement for) operating activities.

Related questions

The Data Given Below Are from the Accounting Records of ...

Comparative Balance Sheets and the Income Statements for Ellis Corporation ...

The Cost of Merchandise Sold During the Year Was $45,000 ...

A Comparative Balance Sheet for Halpern Corporation Is Presented Below ...

Show Company Had Total Operating Expenses of $153000 in 2016 ...