Asked by Hannah Crenshaw on May 31, 2024

Verified

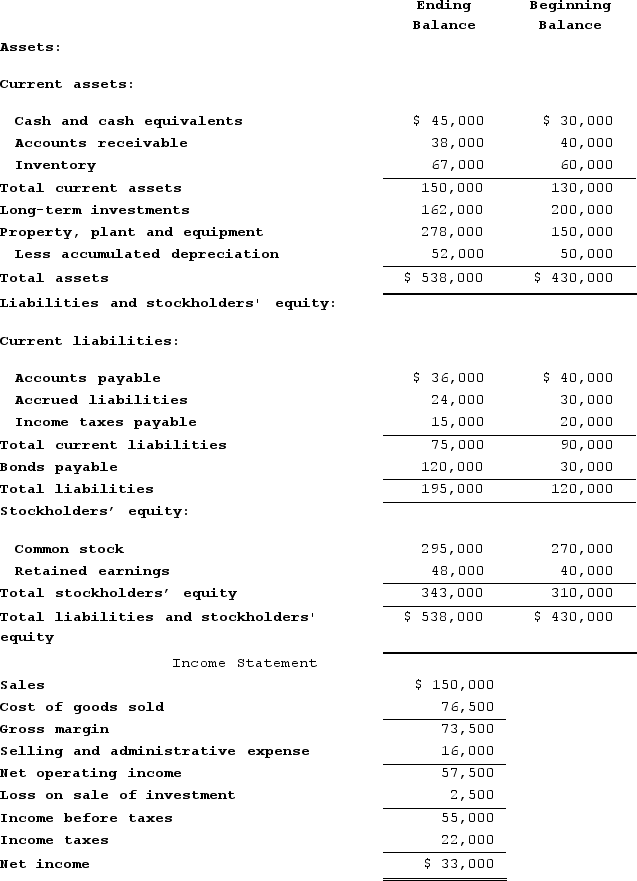

Comparative balance sheets and the income statements for Ellis Corporation are presented below:

The following additional information is available for the year:* During the year, the company sold long-term investments for $35,500 that had been purchased for $38,000.* The company did not sell any property, plant, and equipment during the year or repurchase any of its own common stock.* All sales were on credit.* The company paid a cash dividend of $25,000.* The company paid cash to retire $15,000 of bonds payable.Required:a. Using the indirect method, determine the net cash provided by (used in) operating activities.b. Using the direct method, determine the net cash provided by (used in) operating activities.c. Using the net cash provided by (used in) operating activities amount from either part a or b, prepare a statement of cash flows.Garrison 16e Rechecks 2017-11-21

The following additional information is available for the year:* During the year, the company sold long-term investments for $35,500 that had been purchased for $38,000.* The company did not sell any property, plant, and equipment during the year or repurchase any of its own common stock.* All sales were on credit.* The company paid a cash dividend of $25,000.* The company paid cash to retire $15,000 of bonds payable.Required:a. Using the indirect method, determine the net cash provided by (used in) operating activities.b. Using the direct method, determine the net cash provided by (used in) operating activities.c. Using the net cash provided by (used in) operating activities amount from either part a or b, prepare a statement of cash flows.Garrison 16e Rechecks 2017-11-21

Long-term Investments

Assets purchased by a company that are intended to be held for more than one year, typically including stocks, bonds, or real estate.

Bonds Payable

Long-term liabilities represented by bonds that a company must repay at a future date, often including periodic interest payments.

Cash Dividend

A distribution of profits by a company to its shareholders, typically given as cash.

- Learn the method of assembling the cash flow statement through the indirect technique.

- Understand the preparation of the statement of cash flows using the direct method.

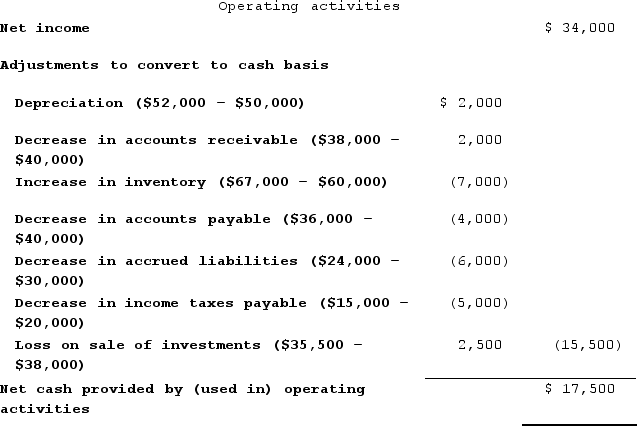

- Determine the net cash provided by (used in) operating activities.

Verified Answer

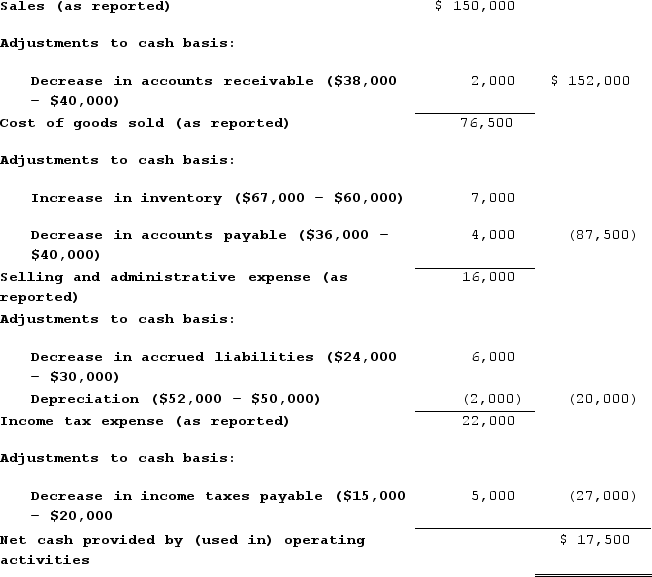

b.Net cash provided by (used in) operating activities-direct method.

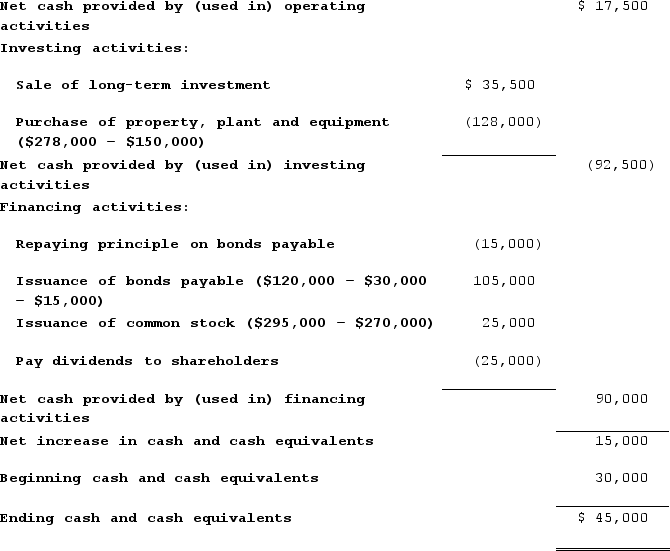

b.Net cash provided by (used in) operating activities-direct method. c.Statement of cash flows

c.Statement of cash flows

Learning Objectives

- Learn the method of assembling the cash flow statement through the indirect technique.

- Understand the preparation of the statement of cash flows using the direct method.

- Determine the net cash provided by (used in) operating activities.

Related questions

Carson Corporation's Comparative Balance Sheet and Income Statement for Last ...

On the Basis of the Following Data for Breach Co ...

The Income Statement Disclosed the Following Items for the Current ...

When Computing the Net Cash Provided by Operating Activities Under ...

Complete the Following Statement of Cash Flows Using the Indirect ...