Asked by Andrew Cavender on Jun 19, 2024

Verified

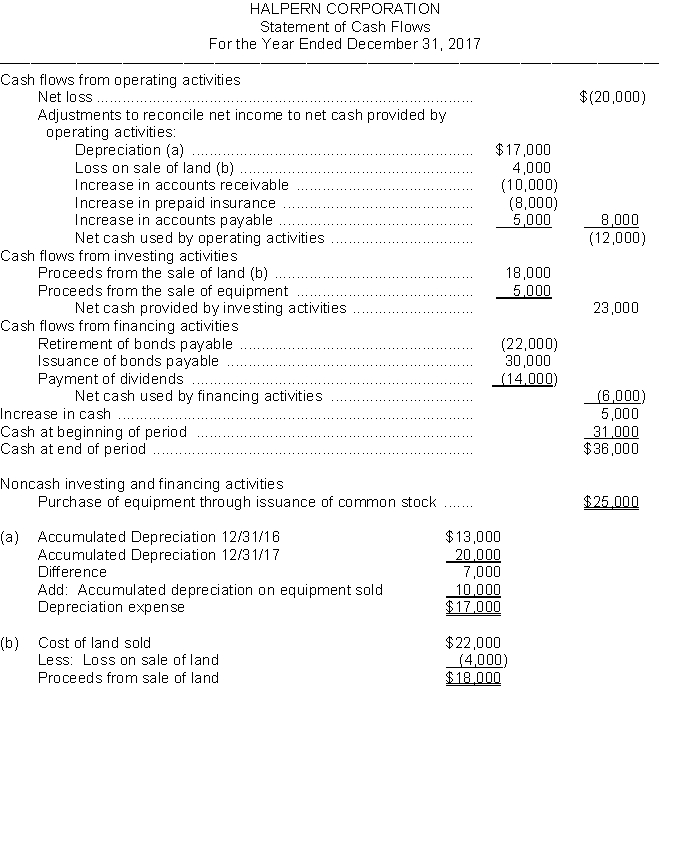

A comparative balance sheet for Halpern Corporation is presented below: HALPERN CORPORATION Comparative Balance Sheet20172016 Assets Cash $36,000$31,000 Accounts receivable (net) 70,00060,000 Prepaid insurance 25,00017,000 Land 18,00040,000 Equipment 70,00060,000 Accumulated depreciation (20,000‾)(13,000‾) Total Assets $199,000‾$195,000‾\begin{array}{c}\text { HALPERN CORPORATION}\\\text { Comparative Balance Sheet}\\\\\begin{array}{lrr}&2017&2016\\\text { Assets }\\\text { Cash } & \$ 36,000 & \$ 31,000 \\\text { Accounts receivable (net) } & 70,000 & 60,000 \\\text { Prepaid insurance } & 25,000 & 17,000 \\\text { Land } & 18,000 & 40,000 \\\text { Equipment } & 70,000 & 60,000 \\\text { Accumulated depreciation } & \underline{(20,000}) & \underline{(13,000}) \\\quad \text { Total Assets } & \underline{\$ 199,000} & \underline{\$ 195,000}\end{array}\end{array} HALPERN CORPORATION Comparative Balance Sheet Assets Cash Accounts receivable (net) Prepaid insurance Land Equipment Accumulated depreciation Total Assets 2017$36,00070,00025,00018,00070,000(20,000)$199,0002016$31,00060,00017,00040,00060,000(13,000)$195,000 Liabilities and Stockholders’ Equity Accounts payable $11,000$,000 Bonds payable 27,00019,000 Common stock 140,000115,000 Retained earnings 21,00055,000 Total liabilities and stockholders’ equity $199,000$195,000\begin{array}{lrr}\text { Liabilities and Stockholders' Equity }\\\text { Accounts payable } & \$ 11,000 & \$, 000 \\\text { Bonds payable } & 27,000 & 19,000 \\\text { Common stock } & 140,000 & 115,000 \\\text { Retained earnings } & 21,000 & 55,000 \\\quad \text { Total liabilities and stockholders' equity } & \$ 199,000 & \$ 195,000\end{array} Liabilities and Stockholders’ Equity Accounts payable Bonds payable Common stock Retained earnings Total liabilities and stockholders’ equity $11,00027,000140,00021,000$199,000$,00019,000115,00055,000$195,000 Additional information:

1. Net loss for 2017 is $20000.

2. Cash dividends of $14000 were declared and paid in 2017.

3. Land was sold for cash at a loss of $4000. This was the only land transaction during the year.

4. Equipment with a cost of $15000 and accumulated depreciation of $10000 was sold for $5000 cash.

5. $22000 of bonds were retired during the year at carrying (book) value.

6. Equipment was acquired for common stock. The fair value of the stock at the time of the exchange was $25000.

Instructions

Prepare a statement of cash flows for the year ended 2017 using the indirect method.

Indirect Method

A way of reporting cash flows from operating activities in the cash flow statement by adjusting net income for changes in non-cash accounts.

Comparative Balance Sheet

A comparative balance sheet presents the financial position of a company at different points in time side by side, to analyze trends or changes in financial status.

Net Loss

Net loss refers to the result when a company's total expenses exceed its total revenues during a specific period, indicating a negative profitability.

- Utilize the direct and indirect techniques to ascertain net cash generated from operating activities.

- Determine the impact of balance sheet account variations on cash flow.

- Ready the operational segment of the cash flow statement through the application of the indirect approach.

Verified Answer

SD

Learning Objectives

- Utilize the direct and indirect techniques to ascertain net cash generated from operating activities.

- Determine the impact of balance sheet account variations on cash flow.

- Ready the operational segment of the cash flow statement through the application of the indirect approach.