Asked by Santiago Quirós on May 11, 2024

Verified

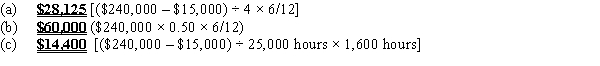

Machinery is purchased on July 1 of the current fiscal year for $240,000. It is expected to have a useful life of four years, or 25,000 operating hours, and a residual value of $15,000. Compute the depreciation for the last six months of the current fiscal year ending December 31 by each of the following methods:

(a)Straight-line

(b)Double-declining-balance

(c)Units-of-activity

(used for 1,600 hours during the current year)

Straight-Line

An approach where the expense of an asset is uniformly allocated across its lifespan to calculate depreciation.

Double-Declining-Balance

A depreciation technique that increases the standard rate of depreciation twofold, thus diminishing an asset's value at a faster pace.

Units-of-Activity

A depreciation method that allocates the cost of an asset over its useful life based on the number of units it produces or hours it operates.

- Find depreciable cost and ascertain depreciation expense employing different models, such as straight-line, double-declining balance, and units of activity.

Verified Answer

TB

Learning Objectives

- Find depreciable cost and ascertain depreciation expense employing different models, such as straight-line, double-declining balance, and units of activity.