Asked by Bryce Takeyama on May 01, 2024

Verified

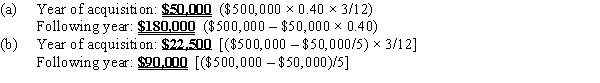

Determine the depreciation for the year of acquisition and for the following year of a fixed asset acquired on October 1 for $500,000 with an estimated life of five years, and residual value of $50,000, using

(a) the double-declining-balance method and

(b) the straight-line method. Assume a fiscal year ending December 31.

Double-Declining-Balance Method

A depreciation technique that accelerates the rate at which an asset loses value, doubling the rate of the straight-line depreciation method.

Straight-Line Method

A depreciation technique that allocates an equal amount of depreciation to each year of the asset's useful life.

Depreciation

The planned distribution of the costs associated with a tangible asset over its usage period.

- Evaluate depreciable cost and derive depreciation expense by adopting several methodologies, notably straight-line, double-declining balance, and units of activity.

Verified Answer

ZK

Learning Objectives

- Evaluate depreciable cost and derive depreciation expense by adopting several methodologies, notably straight-line, double-declining balance, and units of activity.