Asked by Arthur Brooks on Jul 06, 2024

Verified

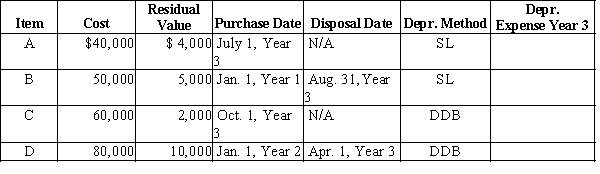

For each of the following fixed assets, determine the depreciation expense for Year 3:Disposal date is N/A if asset is still in use.Method: SL = straight-line; DDB = double-declining-balanceAssume the estimated life is five years for each asset.

Double-Declining-Balance

An accelerated depreciation method that doubles the straight-line depreciation rate, reducing the asset's book value more quickly.

Straight-Line

A method of calculating depreciation of an asset, which allocates an equal amount of depreciation each year over the asset's useful life.

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life, reflecting the asset's consumption, wear and tear, or obsolescence.

- Calculate depreciable cost and ascertain depreciation expense using multiple approaches, encompassing straight-line, double-declining balance, and units of activity.

Verified Answer

EJ

Learning Objectives

- Calculate depreciable cost and ascertain depreciation expense using multiple approaches, encompassing straight-line, double-declining balance, and units of activity.