Asked by Anaelle Gauthier on May 29, 2024

Verified

Grayson's Lumber Mill sold two machines in 2018. The following information pertains to the two machines: Purchase Useful Salvage Depreciation Sales Machine Cost Date Life Value Method Date Sold Price #1$66,0007/1/145yrs$6,000 Straight-line 7/1/18$15,000#2$50,0007/1/175yrs$5,000 Double-declining- 12/31/18$30,000 balance \begin{array}{cccccccc}&&\text { Purchase}&\text { Useful}&\text { Salvage }&\text { Depreciation } && \text { Sales }\\\text { Machine }&\text {Cost}&\text { Date }&\text {Life}&\text { Value}&\text { Method }&\text {Date Sold}&\text { Price }\\\hline\# 1 &\$66,000& 7 / 1 / 14 & 5 \mathrm{yrs} & \$ 6,000 & \text { Straight-line } & 7 / 1 / 18 &\$15,000\\\#2& \$ 50,000 & 7 / 1 / 17 & 5 \mathrm{yrs} & \$ 5,000 & \text { Double-declining- } & 12 / 31 / 18&\$30,000 \\&&&&&\text { balance }\\\end{array} Machine #1#2Cost$66,000$50,000 Purchase Date 7/1/147/1/17 UsefulLife5yrs5yrs Salvage Value$6,000$5,000 Depreciation Method Straight-line Double-declining- balance Date Sold7/1/1812/31/18 Sales Price $15,000$30,000 Instructions

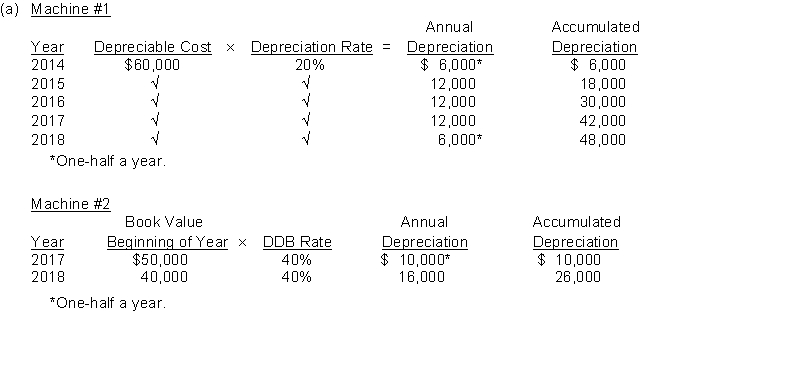

(a) Compute the depreciation on each machine to the date of disposal.

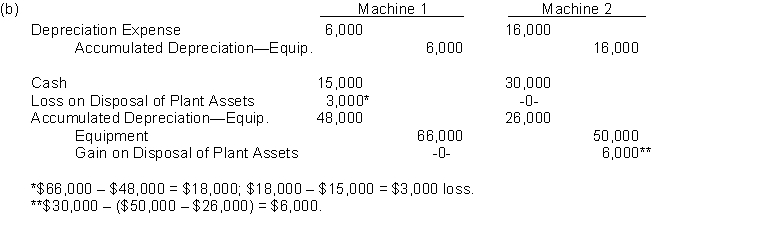

(b) Prepare the journal entries in 2018 to record 2018 depreciation and the sale of each machine.

Straight-line Method

A depreciation calculation technique that evenly spreads the loss in value of an asset across each year of its expected useful lifespan.

Double-declining-balance Method

A depreciation approach that speeds up the process by using a rate twice that of the typical straight-line method.

Sales Price

The amount of money charged for a product or service, or the sum a customer pays to purchase something.

- Evaluate the cost of depreciation and assess the book value for permanent assets.

- Organize and interpret entries in the journal for dealings that involve depreciation, disposal, and selling of assets.

- Calculate and record depletion of natural resources and depreciation of related assets.

Verified Answer

Learning Objectives

- Evaluate the cost of depreciation and assess the book value for permanent assets.

- Organize and interpret entries in the journal for dealings that involve depreciation, disposal, and selling of assets.

- Calculate and record depletion of natural resources and depreciation of related assets.

Related questions

Brown Company Purchased Equipment in 2010 for $150000 and Estimated ...

Presented Below Are Two Independent Situations ...

Dougan Company Purchased Equipment on January 1 2016 for $90000 ...

The December 31 2016 Balance Sheet of Jensen Company Showed ...

On January 1 2015 Miraz Company Purchased Furniture for $7800 ...