Asked by Mulham Shbeib on Apr 29, 2024

Verified

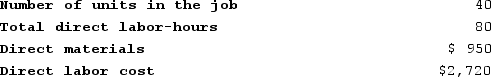

Lueckenhoff Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $497,000, variable manufacturing overhead of $2.40 per direct labor-hour, and 70,000 direct labor-hours. The company has provided the following data concerning Job T498 which was recently completed:  The amount of overhead applied to Job T498 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied to Job T498 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $568

B) $192

C) $760

D) $952

Predetermined Overhead Rate

A rate calculated before a period begins, used to allocate estimated overhead costs to products or job orders based on a selected activity base, such as direct labor hours.

Variable Manufacturing Overhead

Costs in manufacturing that vary with the level of production output, such as utilities for machinery.

Fixed Manufacturing Overhead

The set of costs associated with the production process that do not change with the level of production, including rent, salaries, and insurance.

- Master the technique of apportioning manufacturing overhead to various jobs, looking at the criteria of hours spent in direct labor or machine usage.

Verified Answer

Predetermined overhead rate = (Total fixed manufacturing overhead cost + Total variable manufacturing overhead cost) / Total direct labor-hours

Predetermined overhead rate = ($497,000 + (70,000 x $2.40)) / 70,000

Predetermined overhead rate = $557,000 / 70,000

Predetermined overhead rate = $7.96 per direct labor-hour

The amount of overhead applied to Job T498 can be calculated as follows:

Overhead applied to Job T498 = Predetermined overhead rate x Actual direct labor-hours used on Job T498

Overhead applied to Job T498 = $7.96 x 95

Overhead applied to Job T498 = $756.20

Therefore, the closest option to the amount of overhead applied to Job T498 is C) $760.

Learning Objectives

- Master the technique of apportioning manufacturing overhead to various jobs, looking at the criteria of hours spent in direct labor or machine usage.

Related questions

The Work in Process Inventory Account of a Manufacturing Company ...

Acheson Corporation, Which Applies Manufacturing Overhead on the Basis of ...

The February Cash Disbursements for Manufacturing Overhead on the Manufacturing ...

The Assembly Department's Factory Overhead Rate Is ...

The Total Factory Overhead Allocated Per Unit of Dings Is