Asked by Alexa Gonzalez on May 03, 2024

Verified

The February cash disbursements for manufacturing overhead on the manufacturing overhead budget should be:

A) $24,640

B) $33,760

C) $30,080

D) $5,440

Cash Disbursements

Payments made by a business, including expenses, debt payments, and purchases of assets.

Manufacturing Overhead

Indirect factory-related costs that are incurred when a product is manufactured.

- Acquire knowledge of the method used in allocating manufacturing overhead costs based on direct labor hours for budgeting purposes.

Verified Answer

JK

Jaspreet kaur DhillonMay 10, 2024

Final Answer :

C

Explanation :

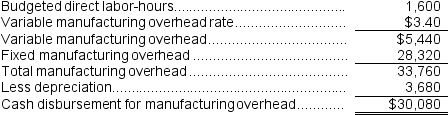

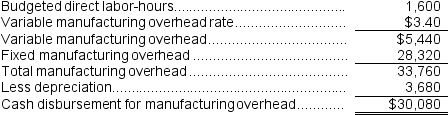

In order to calculate the February cash disbursements for manufacturing overhead, we need to find the total amount of manufacturing overhead costs for the month of February.

Using the manufacturing overhead budget formula:

Total manufacturing overhead costs = Budgeted direct labor hours x Budgeted overhead rate

Total manufacturing overhead costs = 1,000 DLH x $30.08 per DLH

Total manufacturing overhead costs = $30,080

Therefore, the February cash disbursements for manufacturing overhead would be $30,080.

Using the manufacturing overhead budget formula:

Total manufacturing overhead costs = Budgeted direct labor hours x Budgeted overhead rate

Total manufacturing overhead costs = 1,000 DLH x $30.08 per DLH

Total manufacturing overhead costs = $30,080

Therefore, the February cash disbursements for manufacturing overhead would be $30,080.

Explanation :  Reference: CH08-Ref27

Reference: CH08-Ref27

Davis Corporation is preparing its Manufacturing Overhead Budget for the fourth quarter of the year.The budgeted variable manufacturing overhead rate is $1.70 per direct labor-hour; the budgeted fixed manufacturing overhead is $116,000 per month, of which $30,000 is factory depreciation.

Reference: CH08-Ref27

Reference: CH08-Ref27Davis Corporation is preparing its Manufacturing Overhead Budget for the fourth quarter of the year.The budgeted variable manufacturing overhead rate is $1.70 per direct labor-hour; the budgeted fixed manufacturing overhead is $116,000 per month, of which $30,000 is factory depreciation.

Learning Objectives

- Acquire knowledge of the method used in allocating manufacturing overhead costs based on direct labor hours for budgeting purposes.

Related questions

Lueckenhoff Corporation Uses a Job-Order Costing System with a Single ...

Haylock Incorporated Bases Its Manufacturing Overhead Budget on Budgeted Direct ...

The Manufacturing Overhead Budget at Foshay Corporation Is Based on ...

The Manufacturing Overhead Budget at Franklyn Corporation Is Based on ...

Arciba Incorporated Bases Its Manufacturing Overhead Budget on Budgeted Direct ...