Asked by Rebecca Dooley on Jun 10, 2024

Verified

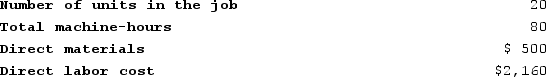

Kostelnik Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $237,000, variable manufacturing overhead of $3.90 per machine-hour, and 30,000 machine-hours. The company has provided the following data concerning Job A496 which was recently completed:  If the company marks up its unit product costs by 40% then the selling price for a unit in Job A496 is closest to: (Round your intermediate calculations to 2 decimal places.)

If the company marks up its unit product costs by 40% then the selling price for a unit in Job A496 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $186.20

B) $272.28

C) $72.08

D) $252.28

Selling Price

The amount of money charged for a product or service, determined by factors such as cost, market demand, and competition.

Unit Product Costs

Unit product costs are the total expenses incurred in producing a single unit of product, including direct materials, direct labor, and manufacturing overhead, crucial for pricing and profitability analyses.

Markup

The difference between the cost of a good or service and its selling price, expressed as a percentage of the cost.

- Calculate sales prices by considering the unit costs and the percentages of markup.

Verified Answer

Direct materials = $16,700

Direct labor = $10,000

Indirect manufacturing cost = predetermined overhead rate x actual machine-hours

= $3.90 x 4,500 (from the job cost sheet)

= $17,550

Total manufacturing cost = $16,700 + $10,000 + $17,550 = $44,250

Next, we need to add the markup of 40% to get the selling price:

Selling price = Total manufacturing cost x (1 + markup percentage)

= $44,250 x 1.4

= $61,950

Finally, we need to divide the total selling price by the number of units produced in Job A496 to get the selling price per unit:

Selling price per unit = $61,950 / 200

= $309.75

Therefore, the closest option is D) $252.28, which is the only option that falls in the range of the calculated amount.

Learning Objectives

- Calculate sales prices by considering the unit costs and the percentages of markup.

Related questions

Cull Corporation Uses a Job-Order Costing System with a Single ...

Cull Corporation Uses a Job-Order Costing System with a Single ...

Bolander Corporation Uses a Job-Order Costing System with a Single ...

As a Source of Income After Retirement, Ian Donnelly Sells ...

Henry Donaldson Sold Kitchen Equipment to Homeowners Although He Made ...