Asked by Alexandria Kunzler on Jul 02, 2024

Verified

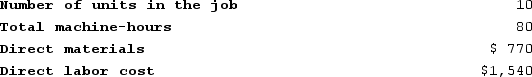

Cull Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $433,100, variable manufacturing overhead of $2.20 per machine-hour, and 61,000 machine-hours. The company has provided the following data concerning Job X455 which was recently completed:  If the company marks up its unit product costs by 25% then the selling price for a unit in Job X455 is closest to: (Round your intermediate calculations to 2 decimal places.)

If the company marks up its unit product costs by 25% then the selling price for a unit in Job X455 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $406.75

B) $305.40

C) $76.35

D) $381.75

Selling Price

The amount of money charged for a product or service, determined by considering costs, market demand, competition, and profitability.

Unit Product Costs

The calculated cost assigned to a single unit of product, typically including direct materials, direct labor, and allocated overhead.

Markup

Markup refers to the amount added to the cost price of goods to cover overhead and profit, calculated as a percentage of the cost.

- Establish pricing by factoring in the costs per unit and the applied markup percentages.

Verified Answer

Fixed manufacturing overhead cost = $433,100

Variable manufacturing overhead cost per machine-hour = $2.20

Machine-hours = 61,000

Predetermined overhead rate = (Total fixed manufacturing overhead cost + Total variable manufacturing overhead cost) / Total machine-hours

= ($433,100 + ($2.20 x 61,000)) / 61,000

= $0.072 per machine-hour

2) Calculation of total manufacturing cost for Job X455:

Direct materials cost = $29,550

Direct labor cost = $23,640

Manufacturing overhead cost = Predetermined overhead rate x Machine-hours used

= $0.072 x 1,800 machine-hours

= $129.60

Total manufacturing cost = $29,550 + $23,640 + $129.60 = $53,319.60

3) Calculation of markup and selling price:

Markup = 25% of total manufacturing cost = 0.25 x $53,319.60 = $13,329.90

Selling price = Total manufacturing cost + Markup

= $53,319.60 + $13,329.90

= $66,649.50

Selling price per unit = Selling price / Number of units produced

= $66,649.50 / 174 units

= $383.63 (rounded to the nearest cent)

Therefore, the closest selling price for a unit in Job X455 is D) $381.75.

Learning Objectives

- Establish pricing by factoring in the costs per unit and the applied markup percentages.

Related questions

Kostelnik Corporation Uses a Job-Order Costing System with a Single ...

Cull Corporation Uses a Job-Order Costing System with a Single ...

Bolander Corporation Uses a Job-Order Costing System with a Single ...

Henry Donaldson Sold Kitchen Equipment to Homeowners Although He Made ...

Clark Thomas Wants to Purchase a Side Table for His ...