Asked by Blake Waldman on May 30, 2024

Verified

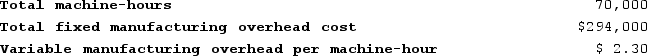

Bolander Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job M825 was completed with the following characteristics:

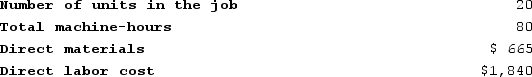

Recently, Job M825 was completed with the following characteristics:

If the company marks up its unit product costs by 40% then the selling price for a unit in Job M825 is closest to: (Round your intermediate calculations to 2 decimal places.)

If the company marks up its unit product costs by 40% then the selling price for a unit in Job M825 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $60.50

B) $175.35

C) $211.75

D) $231.75

Selling Price

The amount of money charged for a product or service, or the sum for which something is sold on the market.

Unit Product Costs

Unit product costs are the total expense incurred to produce, store, and sell one unit of a product, including material, labor, and overhead rates.

Job M825

A specific task or project identified by a unique code, in this case, M825, likely within a job costing system.

- Identify the market prices by taking into account the per-unit costs and the planned markup percentages.

Verified Answer

Direct materials = $12,650

Direct labor = $9,700

Manufacturing overhead = $9,460 ($15 per MH x 630 MHs)

Total manufacturing costs = $31,810

To find the selling price, we need to mark up the unit product cost by 40%:

Unit product cost = $31,810 / 630 units = $50.50

Selling price = $50.50 x 1.4 = $70.70

Therefore, the closest answer choice is C) $211.75 (since the question asks for the selling price of a unit, and the total manufacturing cost is spread out over 3 units).

Learning Objectives

- Identify the market prices by taking into account the per-unit costs and the planned markup percentages.

Related questions

Cull Corporation Uses a Job-Order Costing System with a Single ...

Kostelnik Corporation Uses a Job-Order Costing System with a Single ...

Cull Corporation Uses a Job-Order Costing System with a Single ...

Henry Donaldson Sold Kitchen Equipment to Homeowners Although He Made ...

Clark Thomas Wants to Purchase a Side Table for His ...