Asked by Diana Mitrea Stoicescu on Jun 14, 2024

Verified

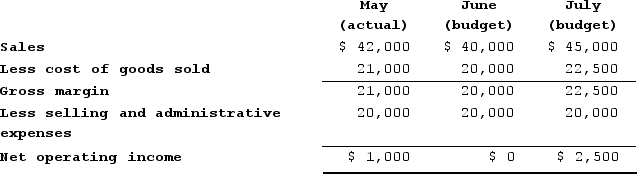

KAB Incorporated, a small retail store, had the following results for May. The budgets for June and July are also given.  Sales are collected 80% in the month of the sale and the balance in the month following the sale. (There are no bad debts.) The goods that are sold are purchased in the month prior to sale. Suppliers of the goods are paid in the month following the sale. The "selling and administrative expenses" are paid in the month of the sale.The cash disbursements during June for goods purchased for sale and for selling and administrative expenses should be:

Sales are collected 80% in the month of the sale and the balance in the month following the sale. (There are no bad debts.) The goods that are sold are purchased in the month prior to sale. Suppliers of the goods are paid in the month following the sale. The "selling and administrative expenses" are paid in the month of the sale.The cash disbursements during June for goods purchased for sale and for selling and administrative expenses should be:

A) $40,000

B) $41,000

C) $42,500

D) $43,500

Cash Disbursements

The total amount of money paid out by a business for all its expenses and investments during a specific period.

Selling Expense

Costs incurred directly from the selling of goods or services, such as sales commissions and advertising expenses.

Sales Collection

The process of receiving payment from customers for goods or services sold, impacting a company's cash flow.

- Master and put into practice the core principles of preparing budgets, specifically relating to sales, production, and direct labor expenses.

- Acquire knowledge on the impact that operating budgets have on cash flow, focusing on the collection from sales, purchases made, and expenses incurred.

Verified Answer

- Collection in May = $60,000 x 80% = $48,000

- Collection in June = $60,000 x 20% = $12,000

- Purchases for June (goods sold in July) = $50,000

- Selling and administrative expenses for June = $9,000

- Total cash disbursement in June = Purchases for June + Selling and administrative expenses for June = $50,000 + $9,000 = $41,000

Learning Objectives

- Master and put into practice the core principles of preparing budgets, specifically relating to sales, production, and direct labor expenses.

- Acquire knowledge on the impact that operating budgets have on cash flow, focusing on the collection from sales, purchases made, and expenses incurred.

Related questions

Bonkowski Corporation Makes One Product and Has Provided the Following ...

KAB Incorporated, a Small Retail Store, Had the Following Results ...

A Formal Statement of Future Plans,usually Expressed in Monetary Terms,is ...

All of the Following Are Steps in the Budgetary Control ...

When Preparing the Cash Budget,all of the Following Should Be ...