Asked by Yaneth Restrepo on May 06, 2024

Verified

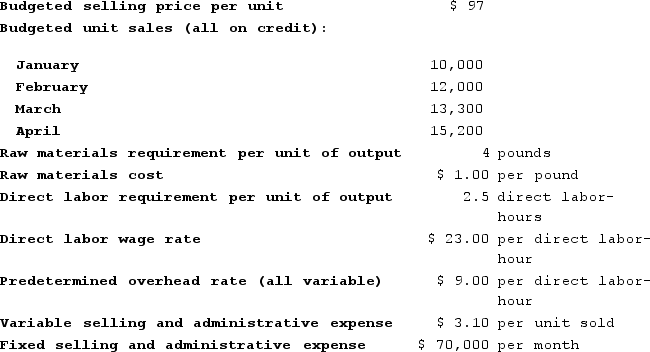

Bonkowski Corporation makes one product and has provided the following information to help prepare the master budget for the next four months of operations:  Credit sales are collected:30% in the month of the sale70% in the following monthRaw materials purchases are paid:30% in the month of purchase70% in the following monthThe ending finished goods inventory should equal 30% of the following month's sales. The ending raw materials inventory should equal 10% of the following month's raw materials production needs.The estimated selling and administrative expense for February is closest to:

Credit sales are collected:30% in the month of the sale70% in the following monthRaw materials purchases are paid:30% in the month of purchase70% in the following monthThe ending finished goods inventory should equal 30% of the following month's sales. The ending raw materials inventory should equal 10% of the following month's raw materials production needs.The estimated selling and administrative expense for February is closest to:

A) $71,470

B) $37,200

C) $107,200

D) $70,000

Master Budget

A comprehensive financial plan for a company's future operations, including multiple subsidiary budgets.

Selling Expense

Expenses directly associated with the sale of a product or service, including advertising, sales commissions, and promotional materials.

Credit Sales

Sales made on credit, where the customer agrees to pay at a future date.

- Identify the components of a master budget and their interrelationships.

- Understand the cash flow impacts derived from operating budgets including sales collection, purchases, and expense payments.

Verified Answer

BL

Brianna LongoriaMay 12, 2024

Final Answer :

C

Explanation :

To prepare the master budget, we need to consider the following components:

1. Sales budget:

Month Sales Collection (30%) Collection (70%)

-------------------------------------------

Jan $100 $30 $70

Feb $150 $45 $105

Mar $200 $60 $140

Apr $120 $36 $84

2. Production budget:

Month Sales Ending FG Inventory Total Units Required Production Needed

------------------------------------------------------------------------------

Feb $150 45 (30%) 158 163

Mar $200 48 (30%) 172 180

Apr $120 36 (30%) 130 134

May 156 166

3. Raw materials budget:

Month Production Needed Ending RM Inventory Total RM Required Purchases (30%) Purchases (70%)

--------------------------------------------------------------------------------------------------

Feb 163 14 (10%) 163 49 114

Mar 180 16 (10%) 180 54 126

Apr 134 15 (10%) 134 40 94

May 166 50 116

4. Selling and administrative expense budget:

Month Budget Amount

----------------------

Feb $107,200

Mar $110,000

Apr $118,000

May $120,000

The estimated selling and administrative expense for February is closest to $107,200 (option C).

1. Sales budget:

Month Sales Collection (30%) Collection (70%)

-------------------------------------------

Jan $100 $30 $70

Feb $150 $45 $105

Mar $200 $60 $140

Apr $120 $36 $84

2. Production budget:

Month Sales Ending FG Inventory Total Units Required Production Needed

------------------------------------------------------------------------------

Feb $150 45 (30%) 158 163

Mar $200 48 (30%) 172 180

Apr $120 36 (30%) 130 134

May 156 166

3. Raw materials budget:

Month Production Needed Ending RM Inventory Total RM Required Purchases (30%) Purchases (70%)

--------------------------------------------------------------------------------------------------

Feb 163 14 (10%) 163 49 114

Mar 180 16 (10%) 180 54 126

Apr 134 15 (10%) 134 40 94

May 166 50 116

4. Selling and administrative expense budget:

Month Budget Amount

----------------------

Feb $107,200

Mar $110,000

Apr $118,000

May $120,000

The estimated selling and administrative expense for February is closest to $107,200 (option C).

Learning Objectives

- Identify the components of a master budget and their interrelationships.

- Understand the cash flow impacts derived from operating budgets including sales collection, purchases, and expense payments.

Related questions

KAB Incorporated, a Small Retail Store, Had the Following Results ...

KAB Incorporated, a Small Retail Store, Had the Following Results ...

The Master Budget Consists of a Number of Separate but ...

The Sequence of the Budgets Within the Master Budget Begins ...

The Merchandise Purchases Budget Is the Starting Point for Preparing ...