Asked by Reveti Kuche on May 12, 2024

Verified

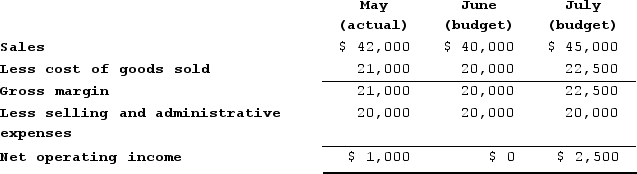

KAB Incorporated, a small retail store, had the following results for May. The budgets for June and July are also given.  Sales are collected 80% in the month of the sale and the balance in the month following the sale. (There are no bad debts.) The goods that are sold are purchased in the month prior to sale. Suppliers of the goods are paid in the month following the sale. The "selling and administrative expenses" are paid in the month of the sale.The amount of cash collected during June should be:

Sales are collected 80% in the month of the sale and the balance in the month following the sale. (There are no bad debts.) The goods that are sold are purchased in the month prior to sale. Suppliers of the goods are paid in the month following the sale. The "selling and administrative expenses" are paid in the month of the sale.The amount of cash collected during June should be:

A) $32,000

B) $40,000

C) $40,400

D) $41,000

Cash Collected

The total amount of money received by a company or individual during a specific period, typically from sales, services, or other transactions.

Selling Expense

Costs incurred to sell products, including advertising, sales commissions, and the expenses of the sales staff.

Sales Collection

The process of receiving payments from customers for goods or services sold.

- Acquire knowledge and employ methods for creating budgets, with a focus on sales, production, and direct labor planning.

- Gain a thorough understanding of how cash flows are influenced by elements of operating budgets, such as sales revenue collection, purchasing activities, and payment of operational costs.

Verified Answer

Cash collected in June = (April sales x 20%) + (May sales x 80%) - May payments to suppliers - May selling and administrative expenses

Cash collected in June = ($16,000 x 20%) + ($40,000 x 80%) - $20,000 - $4,400

Cash collected in June = $3,200 + $32,000 - $20,000 - $4,400

Cash collected in June = $10,800

Therefore, the best choice is C.

Learning Objectives

- Acquire knowledge and employ methods for creating budgets, with a focus on sales, production, and direct labor planning.

- Gain a thorough understanding of how cash flows are influenced by elements of operating budgets, such as sales revenue collection, purchasing activities, and payment of operational costs.

Related questions

KAB Incorporated, a Small Retail Store, Had the Following Results ...

Bonkowski Corporation Makes One Product and Has Provided the Following ...

All of the Following Are Steps in the Budgetary Control ...

A Formal Statement of Future Plans,usually Expressed in Monetary Terms,is ...

The Master Budgeting Process Typically Begins with the Sales Budget ...