Asked by Kristie Smith on Jun 29, 2024

Verified

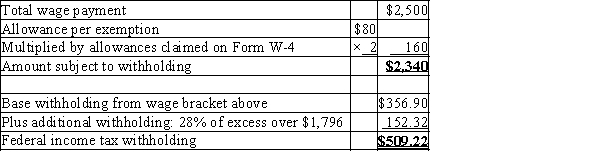

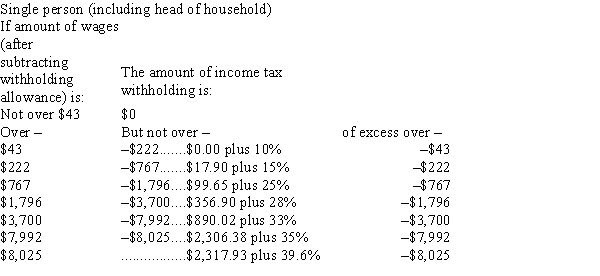

John Woods' weekly gross earnings for the present week were $2,500. Woods has two exemptions. Using an $80 value for each exemption and the tax rate schedule below, what is Woods' federal income tax withholding??

Federal Income Tax

is the tax levied by the national government on individuals' and entities' annual earnings, varying based on income levels and filing status.

Withholding

This refers to the amount of an employee's pay withheld by the employer and sent directly to the government as partial payment of income tax.

Exemptions

Deductions allowed by law to reduce the amount of income that is subject to taxation.

- Assess and calculate the payroll along with corresponding taxes for both the employee and the employer.

Verified Answer

ZK

Learning Objectives

- Assess and calculate the payroll along with corresponding taxes for both the employee and the employer.