Asked by Ainsley Patton on Jun 03, 2024

Verified

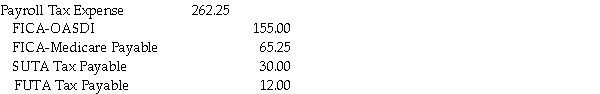

Mike's Door Service's payroll data for the second week of June included the following:  Taxable earnings for state unemployment taxes: $2,000

Taxable earnings for state unemployment taxes: $2,000

Assume the following tax rates:

FICA-OASDI 6.2%

FICA-Medicare 1.45%

State unemployment 1.5%

Federal unemployment 0.06%

Required: Prepare the payroll tax expense entry for Mike's for the second week of June.

State Unemployment

A government-provided insurance program that offers temporary financial assistance to the unemployed who lost their jobs through no fault of their own.

Federal Unemployment

Refers to the United States federal government program that provides unemployment benefits to eligible workers.

FICA-OASDI

Refers to the Social Security portion of the Federal Insurance Contributions Act tax, used to fund the Social Security program in the United States.

- Absorb the techniques for determining various payroll taxes impacting both employees and employers.

- Develop the ability to compose journal entries relevant to payroll and payroll taxes.

Verified Answer

CC

Learning Objectives

- Absorb the techniques for determining various payroll taxes impacting both employees and employers.

- Develop the ability to compose journal entries relevant to payroll and payroll taxes.