Asked by Haley Van Roekel on May 25, 2024

Verified

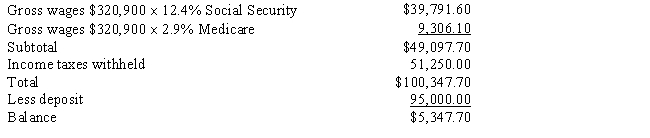

For the first quarter of 2008, DC Construction Company paid total wages of $320,900. The company withheld $51,250 for federal income tax. All wages paid were subject to Social Security and Medicare taxes. If during the quarter DC Construction Company had deposited $95,000 toward its taxes due, how much would be required to send in with its first-quarter Form 941?

Form 941

A tax form used by employers in the United States to report quarterly federal taxes withheld from their employees' earnings.

Social Security

A government program that provides financial assistance to people with insufficient or no income, mainly for the elderly, disabled, and survivors.

Medicare Taxes

Taxes collected from earnings to fund the Medicare program, which provides health insurance for individuals aged 65 and older in the United States.

- Calculate the total tax liability and ascertain the sum payable with quarterly tax submissions, taking into account previous deposits and withholdings.

- Conduct precise evaluations of payroll taxes for both single employees and the total compensation disbursed by the organization.

Verified Answer

SE

Learning Objectives

- Calculate the total tax liability and ascertain the sum payable with quarterly tax submissions, taking into account previous deposits and withholdings.

- Conduct precise evaluations of payroll taxes for both single employees and the total compensation disbursed by the organization.