Asked by Savannah Young Kelsey on Apr 28, 2024

Verified

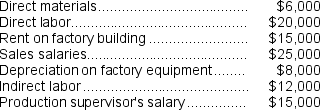

Johansen Corporation uses a predetermined overhead rate based on direct labor-hours to apply manufacturing overhead to jobs.The Corporation has provided the following estimated costs for the next year:  Jameson estimates that 20,000 direct labor-hours will be worked during the year.The predetermined overhead rate per hour will be:

Jameson estimates that 20,000 direct labor-hours will be worked during the year.The predetermined overhead rate per hour will be:

A) $2.50 per direct labor-hour

B) $2.79 per direct labor-hour

C) $3.00 per direct labor-hour

D) $4.00 per direct labor-hour

Predetermined Overhead Rate

An estimated rate used to apply manufacturing overhead to products or job orders, based on expected activity levels.

- Understanding the method and significance of calculating pre-established overhead rates within the realm of cost accounting.

- Differentiating actual overhead costs from applied overhead costs and understanding the importance of the predetermined overhead rate calculation.

Verified Answer

AP

Anthony PruittMay 01, 2024

Final Answer :

A

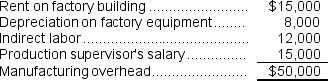

Explanation :  Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base

Predetermined overhead rate = $50,000 ÷ 20,000 direct labor-hours = $2.50 per direct labor-hour

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation basePredetermined overhead rate = $50,000 ÷ 20,000 direct labor-hours = $2.50 per direct labor-hour

Learning Objectives

- Understanding the method and significance of calculating pre-established overhead rates within the realm of cost accounting.

- Differentiating actual overhead costs from applied overhead costs and understanding the importance of the predetermined overhead rate calculation.

Related questions

If the Allocation Base in the Predetermined Overhead Rate Does ...

Brothern Corporation Bases Its Predetermined Overhead Rate on the Estimated ...

The Predetermined Overhead Rate Is Closest To

Martin Company Applies Manufacturing Overhead Based on Direct Labor Hours ...

Landis Company Uses a Job Order Cost System in Each ...