Asked by Lisdrey Cires on Jun 03, 2024

Verified

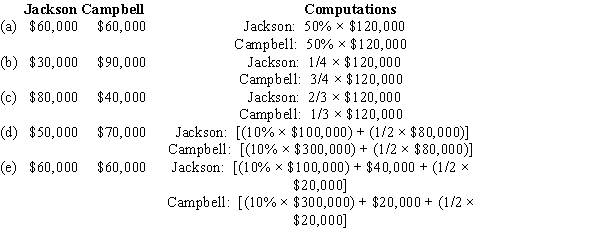

Jackson and Campbell have capital balances of $100,000 and $300,000 respectively. Jackson devotes full time and Campbell one-half time to the business. Determine the division of $120,000 of net income under each of the following assumptions:

(a)No agreement as to division of net income

(b)In ratio of capital balances

(c)In ratio of time devoted to business

(d)Interest of 10% on capital balances and the remainder divided equally

(e)Interest of 10% on capital balances, salaries of $40,000 to Jackson and $20,000 to Campbell, and the remainder divided equally

Capital Balances

Capital balances refer to the amount of money that the owners or partners have invested in a business, not including any profits or losses that the business may earn or incur.

Net Income

The amount of money that remains from revenues after all expenses, taxes, and costs have been subtracted.

Devotes Full Time

A commitment by an individual or employee to allocate all of their working hours to a specific job or task.

- Understand different methods for dividing net income in a partnership.

Verified Answer

Learning Objectives

- Understand different methods for dividing net income in a partnership.

Related questions

Partnership Income and Losses Are Usually Divided on the Basis ...

In the Distribution of Income, the Net Income Is Less ...

Ando Dadd and Porter Formed a Partnership on January 1 ...

Juanita Gomez and Brandi Toomey Have Formed the GT Partnership ...

Carraway and Boos Have a Partnership Agreement Which Includes the ...