Asked by celeste richmond on Apr 29, 2024

Verified

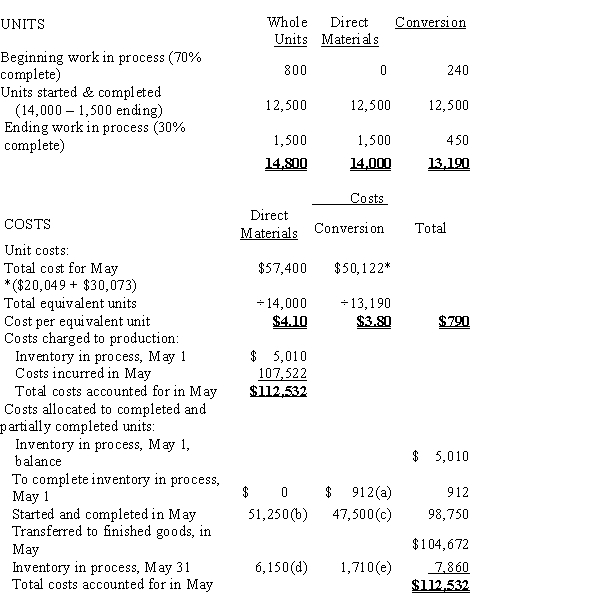

Information for Nichols Manufacturing Company for the month of May is as follows:Beginning work in process:Cost of inventory at process, May 1$5,010Units, 800Direct materials, 100% completeConversion costs, 70% complete?Units started in May, 14,000Costs charged to Work in Process during May:Ending work in process inventory:Direct materials costs, $57,400Units, 1,500Direct labor costs, $20,049Direct materials, 100% completeFactory overhead costs, $30,073Conversion costs, 30% complete?Prepare a cost of production report for the month of May, using the FIFO method.

FIFO Method

"First In, First Out," an inventory valuation method that assumes that the first items placed in inventory are the first sold, affecting the cost of goods sold and inventory valuation.

Direct Materials

Basic substances that can be directly linked to the manufacturing of particular products or services.

Conversion Costs

Conversion Costs are manufacturing expenses related to turning raw materials into finished products, typically including labor and overhead costs.

- Compile costing documentation for production divisions, utilizing assorted methods of inventory costing.

- Distinguish between different costing methods and their impact on cost accounting.

Verified Answer

(a) 240 × $3.80

(a) 240 × $3.80(b) 12,500 × $4.10

(c) 12,500 × $3.80

(d) 1,500 × $4.10

(e) 450 × $3.80

Learning Objectives

- Compile costing documentation for production divisions, utilizing assorted methods of inventory costing.

- Distinguish between different costing methods and their impact on cost accounting.

Related questions

The Inventory at June 1 and Costs Charged to Work ...

Everett Company's Inventory at December 31 and the Costs Charged ...

The Costing Approach That Meets the Requirements of Financial Accounting ...

Analysts Must Recognize That the Use of the Specific Identification ...

Which of the Following Statements Concerning the Unit Product Cost ...