Asked by Tonii White on Jun 15, 2024

Verified

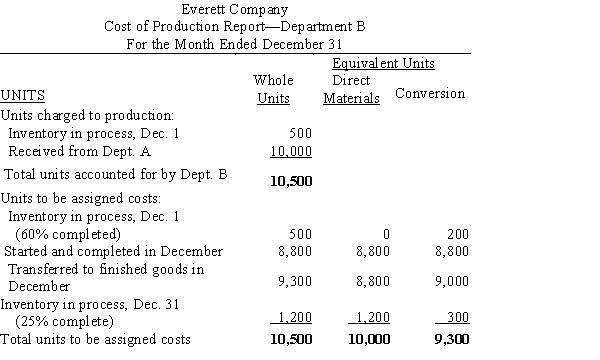

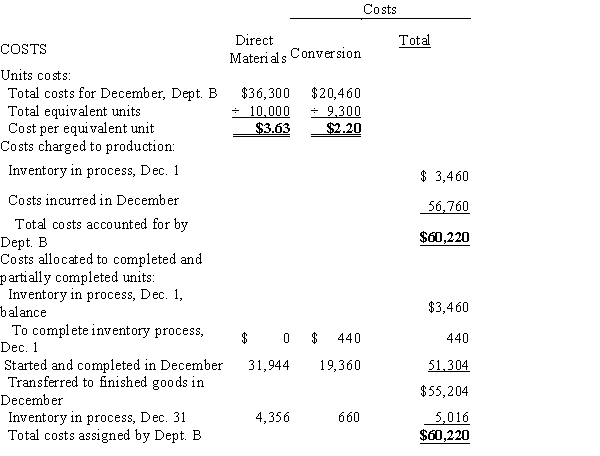

Everett Company's inventory at December 31 and the costs charged to Work in Process-Department B during December are as follows: 500 units, 60% completed 3,460 From Department A, 10,000 units 36,300 Direct labor 7,960 Factory overhead 12,500\begin{array}{lr}500 \text { units, } 60 \% \text { completed } & 3,460 \\\text { From Department A, } 10,000 \text { units } & 36,300 \\\text { Direct labor } & 7,960 \\\text { Factory overhead } & 12,500\end{array}500 units, 60% completed From Department A, 10,000 units Direct labor Factory overhead 3,46036,3007,96012,500 During December, all direct materials are transferred from Department A, and the units in process at December 1 were completed. Of the 10,000 units entering the department, all were completed except 1,200 units that were 25% completed as to conversion costs. Inventories are costed by the first-in, first-out method.Prepare a cost of production report for December.

First-In, First-Out

An accounting method for valuing inventory which assumes that the first items purchased are the first ones sold.

Direct Labor

Labor costs that are directly tied to the production of goods or the provision of services, such as wages of factory workers.

Factory Overhead

All indirect costs associated with the manufacturing process, including costs related to operating the factory such as utilities, equipment depreciation, and maintenance.

- Develop cost analysis reports for manufacturing units employing different inventory valuation techniques.

Verified Answer

Learning Objectives

- Develop cost analysis reports for manufacturing units employing different inventory valuation techniques.

Related questions

The Inventory at June 1 and Costs Charged to Work ...

Information for Nichols Manufacturing Company for the Month of May ...

The Weighted Average Inventories Costing Method Is Particularly Suitable to ...

Under the Periodic Inventories Approach, an Appropriate Journal Entry to ...

Under the Periodic Inventories Approach, the Cost of Goods Sold ...