Asked by Joseph Smith on Jun 17, 2024

Verified

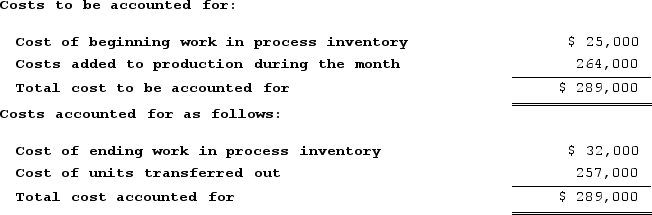

In December, one of the processing departments at Bonine Corporation had ending work in process inventory of $32,000. During the month, $264,000 of costs were added to production and the cost of units transferred out from the department was $257,000. The company uses the first-in, first-out method in its process costing system.Required:Construct a cost reconciliation report for the department for the month of December.

Cost Reconciliation Report

A financial report that reconciles estimated costs with actual costs incurred, often used in manufacturing to track material, labor, and overhead costs against budgeted or standard costs.

Work in Process Inventory

Represents the cost of unfinished goods in the production process, including labor, materials, and overhead.

- Digest and apply the FIFO method in engagements involving process costing.

- Construct a reconciliation report of costs in the context of process costing.

Verified Answer

Learning Objectives

- Digest and apply the FIFO method in engagements involving process costing.

- Construct a reconciliation report of costs in the context of process costing.

Related questions

Claus Corporation Manufactures a Single Product and Uses Process Costing ...

In June, One of the Processing Departments at Sorto Corporation ...

In October, One of the Processing Departments at Ingersoll Corporation ...

Clarks Corporation Uses the First-In, First-Out Method in Its Process ...

Easy Incorporated Uses the First-In, First-Out Method in Its Process ...