Asked by Johana Madrid on May 21, 2024

Verified

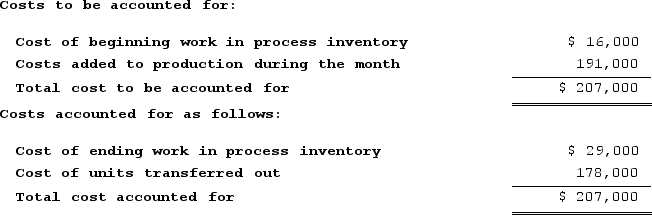

In October, one of the processing departments at Ingersoll Corporation had beginning work in process inventory of $16,000 and ending work in process inventory of $29,000. During the month, $191,000 of costs were added to production. The company uses the first-in, first-out method in its process costing system.Required:Construct a cost reconciliation report for the department for the month of October.

First-In, First-Out Method

An inventory valuation method where goods first received are the first to be sold or used, assuming that older inventory is sold before newer stock.

Cost Reconciliation Report

A document that analyzes and reconciles the differences between the cost of beginning inventory, the cost of goods manufactured, and the cost of goods sold.

Work in Process Inventory

Goods that are in various stages of completion in the production process but are not yet finished products.

- Absorb and put into practice the FIFO methodology in the realm of process costing.

- Compile a cost reconciliation statement within a process costing framework.

Verified Answer

Learning Objectives

- Absorb and put into practice the FIFO methodology in the realm of process costing.

- Compile a cost reconciliation statement within a process costing framework.

Related questions

Claus Corporation Manufactures a Single Product and Uses Process Costing ...

In June, One of the Processing Departments at Sorto Corporation ...

Clarks Corporation Uses the First-In, First-Out Method in Its Process ...

Easy Incorporated Uses the First-In, First-Out Method in Its Process ...

The Following Data Have Been Provided by Corby Corporation for ...