Asked by Michelle Tseng on May 10, 2024

Verified

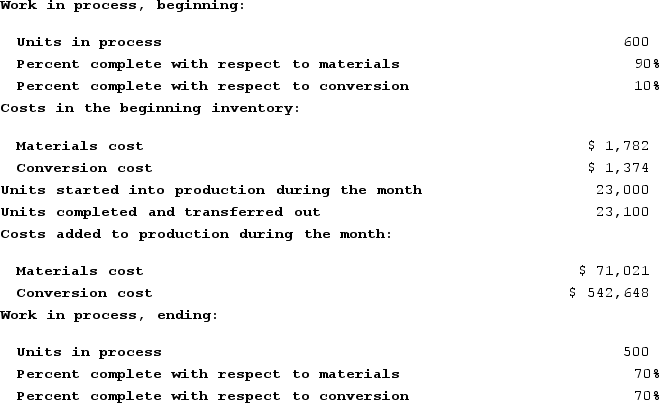

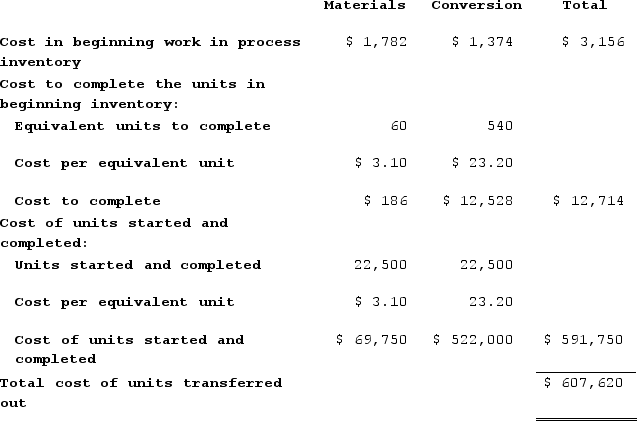

Easy Incorporated uses the first-in, first-out method in its process costing system. The following data concern the operations of the company's first processing department for a recent month.

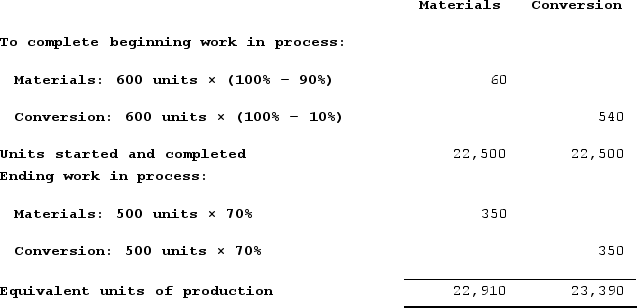

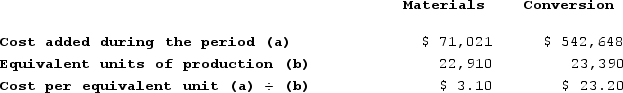

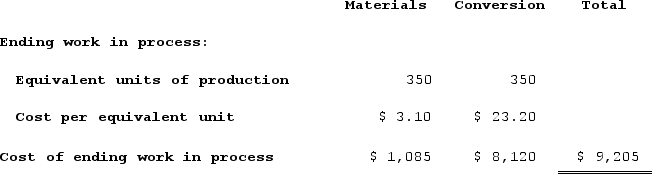

Required: Using the first-in, first-out method:a. Determine the equivalent units of production for materials and conversion costs.b. Determine the cost per equivalent unit for materials and conversion costs.c. Determine the cost of ending work in process inventory.d. Determine the cost of units transferred out of the department during the month.

Required: Using the first-in, first-out method:a. Determine the equivalent units of production for materials and conversion costs.b. Determine the cost per equivalent unit for materials and conversion costs.c. Determine the cost of ending work in process inventory.d. Determine the cost of units transferred out of the department during the month.

First-In, First-Out Method

An inventory valuation method where the goods first produced or acquired are sold or used before newer inventory.

Equivalent Units

A method used in process costing to convert partially completed goods into a comparable number of fully completed units.

Conversion Costs

Costs incurred to convert raw materials into finished products, often including labor and overhead.

- Understand thoroughly and put to use the FIFO method within the scope of process costing.

- Calculate the equivalent units for production employing both the FIFO and weighted-average approaches.

- Identify the cost per equivalent unit in systems of process costing.

Verified Answer

b.

b. c.

c. d.

d.

Learning Objectives

- Understand thoroughly and put to use the FIFO method within the scope of process costing.

- Calculate the equivalent units for production employing both the FIFO and weighted-average approaches.

- Identify the cost per equivalent unit in systems of process costing.

Related questions

In October, One of the Processing Departments at Ingersoll Corporation ...

Farsat Incorporated Uses the First-In, First-Out Method in Its Process ...

The Following Data Have Been Provided by Corby Corporation for ...

In December, One of the Processing Departments at Bonine Corporation ...

Zubris Corporation Uses the First-In, First-Out Method in Its Process ...