Asked by Sandra Feliciano on Jun 13, 2024

Verified

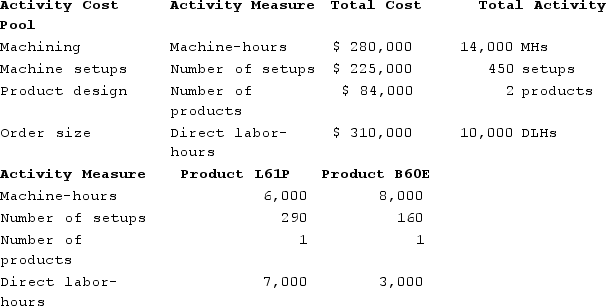

Meli Corporation manufactures two products: Product L61P and Product B60E. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products L61P and B60E.  Using the plantwide overhead rate, the percentage of the total overhead cost that is allocated to Product B60E is closest to:

Using the plantwide overhead rate, the percentage of the total overhead cost that is allocated to Product B60E is closest to:

A) 31.37%

B) 30.00%

C) 10.34%

D) 50.00%

Plantwide Overhead Rate

A single overhead rate calculated by dividing total manufacturing overhead costs by the total measure of activity across the entire plant.

Manufacturing Overhead

All manufacturing costs that are not directly traceable to the product being produced, including costs related to indirect materials, indirect labor, and other indirect expenses.

- Distinguish between the concepts of plantwide overhead rates and the principles of activity-based costing rates.

Verified Answer

RB

Rebekah BowenJun 18, 2024

Final Answer :

B

Explanation :

Using the plantwide overhead rate, the total overhead cost is calculated as follows:

Total overhead cost = Total direct labor-hours x Plantwide overhead rate

= 20,000 DLHs x $8 per DLH

= $160,000

The percentage of the total overhead cost that is allocated to Product B60E is:

Product B60E overhead cost = Total overhead cost x (B60E DLHs / Total DLHs)

= $160,000 x (5,000 / 20,000)

= $40,000

So, the percentage of the total overhead cost that is allocated to Product B60E is:

($40,000 / $160,000) x 100%

= 25%

Therefore, the closest answer choice is B) 30.00%.

Total overhead cost = Total direct labor-hours x Plantwide overhead rate

= 20,000 DLHs x $8 per DLH

= $160,000

The percentage of the total overhead cost that is allocated to Product B60E is:

Product B60E overhead cost = Total overhead cost x (B60E DLHs / Total DLHs)

= $160,000 x (5,000 / 20,000)

= $40,000

So, the percentage of the total overhead cost that is allocated to Product B60E is:

($40,000 / $160,000) x 100%

= 25%

Therefore, the closest answer choice is B) 30.00%.

Learning Objectives

- Distinguish between the concepts of plantwide overhead rates and the principles of activity-based costing rates.