Asked by Lindsey Hagen on Jun 03, 2024

Verified

If the Northern Division's sales last year were $600,000 higher, how would this have changed Nantuor's net operating income? (Assume no change in selling prices, variable expenses per unit, or fixed expenses.)

A) $240,000 increase

B) $60,000 increase

C) $160,000 increase

D) $1,200,000 increase

Northern Division's Sales

The total revenue generated by the Northern Division of a company within a specific period.

Net Operating Income

The total profit of a business after all operating expenses are deducted, but before taxes and interest are considered.

Fixed Expenses

Costs that do not fluctuate with the level of production or sales, remaining constant even when business activity levels change.

- Evaluate the impact of variations in sales volume on net operating income.

Verified Answer

SL

Shara Lyn SantiagoJun 05, 2024

Final Answer :

A

Explanation :

Northern Division:

CM ratio = Contribution margin ÷ Sales

= $1,200,000 ÷ $3,000,000 = 0.40

Change in contribution margin = CM ratio × Change in sales

= 0.40 × $600,000 = $240,000

Reference: CHO7-Ref40

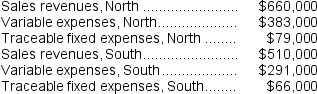

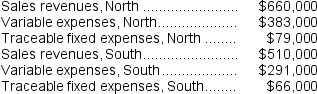

Data for January for Bondi Corporation and its two major business segments, North and South, appear below: In addition, common fixed expenses totaled $179,000 and were allocated as follows: $93,000 to the North business segment and $86,000 to the South business segment.

In addition, common fixed expenses totaled $179,000 and were allocated as follows: $93,000 to the North business segment and $86,000 to the South business segment.

CM ratio = Contribution margin ÷ Sales

= $1,200,000 ÷ $3,000,000 = 0.40

Change in contribution margin = CM ratio × Change in sales

= 0.40 × $600,000 = $240,000

Reference: CHO7-Ref40

Data for January for Bondi Corporation and its two major business segments, North and South, appear below:

In addition, common fixed expenses totaled $179,000 and were allocated as follows: $93,000 to the North business segment and $86,000 to the South business segment.

In addition, common fixed expenses totaled $179,000 and were allocated as follows: $93,000 to the North business segment and $86,000 to the South business segment.

Learning Objectives

- Evaluate the impact of variations in sales volume on net operating income.