Asked by alexis marie logan on May 07, 2024

Verified

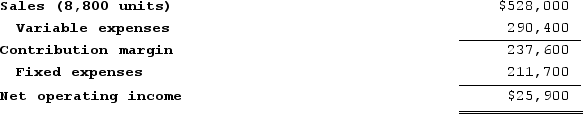

Decaprio Incorporated produces and sells a single product. The company has provided its contribution format income statement for June.  If the company sells 9,200 units, its net operating income should be closest to:

If the company sells 9,200 units, its net operating income should be closest to:

A) $27,077

B) $49,900

C) $36,700

D) $25,900

Contribution Format

The contribution format is a financial statement layout that separates fixed and variable costs, allowing for easier calculation of contribution margin and breakeven analysis.

Net Operating Income

The profit realized from a business's operations after subtracting operating expenses from revenue.

Units

A basic measure or quantity of a product, service, or resource, often used in manufacturing, inventory, and accounting.

- Comprehend and determine the effect of variations in sales volume on net operating income.

Verified Answer

NE

Nicholas EltzrothMay 11, 2024

Final Answer :

C

Explanation :

Using the contribution margin per unit, we can calculate the contribution margin for 9,200 units:

Contribution margin per unit = Sales price per unit - Variable cost per unit

= $50 - $28

= $22

Total contribution margin for 9,200 units = 9,200 units x $22 per unit = $202,400

We can then subtract the total fixed costs to find the net operating income:

Net operating income = Total contribution margin - Total fixed costs

= $202,400 - $165,700

= $36,700

Therefore, the closest answer choice is C) $36,700.

Contribution margin per unit = Sales price per unit - Variable cost per unit

= $50 - $28

= $22

Total contribution margin for 9,200 units = 9,200 units x $22 per unit = $202,400

We can then subtract the total fixed costs to find the net operating income:

Net operating income = Total contribution margin - Total fixed costs

= $202,400 - $165,700

= $36,700

Therefore, the closest answer choice is C) $36,700.

Learning Objectives

- Comprehend and determine the effect of variations in sales volume on net operating income.