Asked by Gavin VandenTop on Jun 28, 2024

Verified

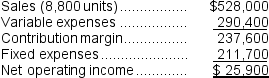

Decaprio Inc.produces and sells a single product.The company has provided its contribution format income statement for June.  If the company sells 9,200 units, its net operating income should be closest to:

If the company sells 9,200 units, its net operating income should be closest to:

A) $27,077

B) $49,900

C) $36,700

D) $25,900

Contribution Format

An income statement layout that segregates fixed costs from variable costs, thus highlighting the contribution margin.

Net Operating Income

The total profit of a company after operating expenses are subtracted from gross profit but before taxes and interest costs are deducted.

Sold Units

The total number of units of a product that have been sold within a specific time period.

- Identify the effects of variations in sales, variable costs, and fixed overheads on an organization's financial outcomes.

- Determine the effect that variations in sales volume have on net operating income.

Verified Answer

Contribution margin per unit = Sales price per unit - Variable expenses per unit

= $80 - $33

= $47

Total contribution margin at 9,200 units = $47 x 9,200 = $432,400

Net operating income = Total contribution margin - Fixed expenses

= $432,400 - $395,700

= $36,700

Therefore, the closest net operating income to 9,200 units sold is $36,700, which is option C.

= $528,000 ÷ 8,800 units = $60 per unit

Variable expenses per unit = Variable expenses ÷ Quantity sold

= $290,400 ÷ 8,800 units = $33 per unit

Unit CM = Selling price per unit - Variable expenses per unit

= $60 per unit - $33 per unit = $27 per unit

Profit = (Unit CM × Q)- Fixed expenses

= ($27 per unit × 9,200 units)- $211,700 = $248,400 - $211,700 = $36,700

Learning Objectives

- Identify the effects of variations in sales, variable costs, and fixed overheads on an organization's financial outcomes.

- Determine the effect that variations in sales volume have on net operating income.

Related questions

Thomason Corporation Has Provided the Following Contribution Format Income Statement ...

The Following Information Pertains to Nova Co ...

Duve Corporation Has Provided the Following Contribution Format Income Statement ...

Sarratt Corporation's Contribution Margin Ratio Is 62% and Its Fixed ...

Decaprio Incorporated Produces and Sells a Single Product ...