Asked by Brooke Patterson on May 14, 2024

Verified

Hawk Company uses a single-column purchases journal a cash payments journal and a general journal to record transactions with its suppliers and others. Record the following transactions in the appropriate journals.

Transactions

Oct. 5 Purchased merchandise on account for $19000 from Harrelson Company. Terms: 2/10 n/30; FOB shipping point.

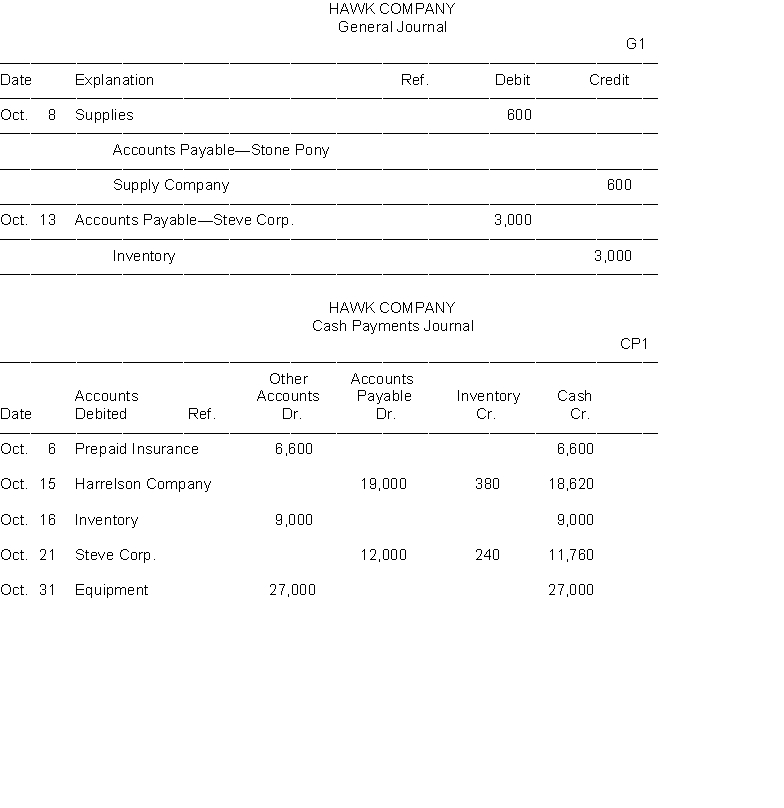

Oct. 6 Paid $6600 to Ken's Insurance Company for a two-year fire insurance policy.

Oct. 8 Purchased store supplies on account for $600 from Stone Pony Supply Company. Terms: 2/10 n/30.

Oct. 11 Purchased merchandise on account for $15000 from Steve Corporation. Terms: 2/10 n/30; FOB shipping point.

Oct. 13 Granted a reduction of $3000 from Steve Corporation for merchandise purchased on October 11 and returned because of damage.

Oct. 15 Paid Harrelson Company for merchandise purchased on October 5 less discount.

Oct. 16 Purchased merchandise for $9000 cash from Williams Company.

Oct. 21 Paid Steve Corporation for merchandise purchased on October 11 less merchandise returned on October 13 less discount.

Oct. 25 Purchased merchandise on account for $21000 from Ozzle Company. Terms: 2/10 n/30; FOB shipping point.

Oct. 31 Purchased equipment for $27000 cash from Guillen Office Supply Company.

Single-Column Purchases Journal

An accounting journal used to record all purchase transactions of a business in a single column, typically for the purchase of inventory on credit.

Cash Payments Journal

A business ledger that documents every payment or cash disbursement made by a company.

General Journal

An accounting journal where all types of transactions are initially recorded, before being posted to specific accounts in the ledger.

- Know how to record and post transactions in special journals.

Verified Answer

AC

Anthony CsargoMay 18, 2024

Final Answer :

HAWK COMPANY Purchases JournalP1 Inventory Dr. Date Account Credited Ref. Accounts Payable Cr. Oct. 5 Harrelson Company 19,000 Oct. 11 Steve Corporation 15,000 Oct. 25 Ozzle Company 21,000\begin{array}{c}\text { HAWK COMPANY }\\\text { Purchases Journal}\\\begin{array}{cccc} &&&&&\text {P1}\\\hline &&&&\text { Inventory Dr. }\\ \hline \text { Date }&& \text {Account Credited }& \text {Ref.}& \text { Accounts Payable Cr. }\\\hline \text { Oct. } & 5 & \text { Harrelson Company } && 19,000 \\\hline \text { Oct. } & 11 & \text { Steve Corporation } && 15,000 \\\hline \text { Oct. } & 25 & \text { Ozzle Company } && 21,000\\\hline\end{array}\end{array} HAWK COMPANY Purchases Journal Date Oct. Oct. Oct. 51125Account Credited Harrelson Company Steve Corporation Ozzle Company Ref. Inventory Dr. Accounts Payable Cr. 19,00015,00021,000P1

Learning Objectives

- Know how to record and post transactions in special journals.