Asked by Samantha Cieless on May 25, 2024

Verified

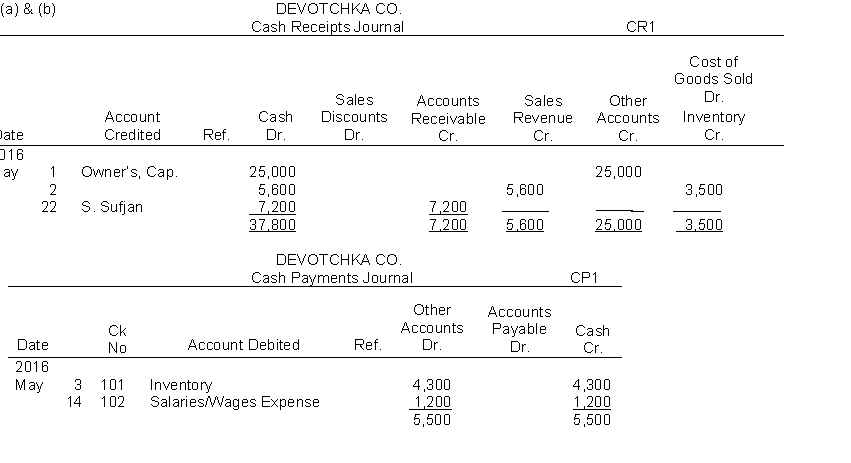

Devotchka Co. uses special journals and a general journal. The following transactions occurred during May 2016.

May 1 Z. Devotchka invested $25000 cash in the business.

2 Sold merchandise to A. A. Bondy for $5600 cash. The cost of the merchandise sold

was $3500.

3 Purchased merchandise for $4300 from Y. Vandyver using check no. 101.

14 Paid salary to D. Dilego $1200 by issuing check no. 102.

16 Sold merchandise on account to S. Stevens for $840 terms n/30. The cost of the

merchandise sold was $500.

22 A check of $7200 is received from S. Sufjan in full for invoice 101; no discount given.

Instructions

(a) Prepare a multiple-column cash receipts journal and a multiple-column cash payments journal. (Use page 1 for each journal.)

(b) Record the transaction(s) for May that should be journalized in the cash receipts journal and cash payments journal.

Special Journals

Customized accounting journals used for recording specific types of transactions that occur frequently.

General Journal

A primary accounting record where all types of financial transactions are initially recorded in chronological order before being posted to specific accounts in the general ledger.

Cash Receipts Journal

A specific financial journal used in accounting to record all cash inflows to a business.

- Become proficient in the technique of entering and sharing transactions in specific journals.

Verified Answer

Learning Objectives

- Become proficient in the technique of entering and sharing transactions in specific journals.

Related questions

Poole Company Maintains Four Special Journals and a General Journal ...

Corona Company Uses a Sales Journal a Cash Receipts Journal ...

Hawk Company Uses a Single-Column Purchases Journal a Cash Payments ...

The Process of Recording a Transaction in the Journal Is ...

An Owner Transfers a Personal Automobile to the Company with ...