Asked by Denia Martinez on Jun 07, 2024

Verified

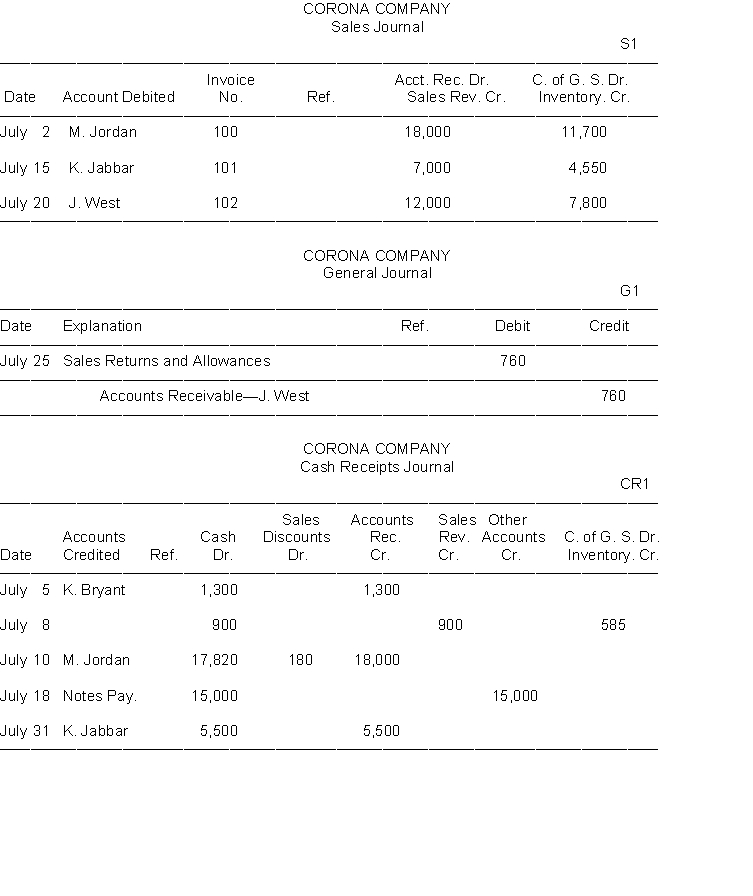

Corona Company uses a sales journal a cash receipts journal and a general journal to record transactions with its customers. Record the following transactions in the appropriate journals. The cost of all merchandise sold was 65% of the sales price.

July 2 Sold merchandise for $18000 to M. Jordan on account. Credit terms 1/10 n/30. Sales invoice No. 100.

July 5 Received a check for $1300 from K. Bryant in payment of his account.

July 8 Sold merchandise to S. O'Neal for $900 cash.

July 10 Received a check in payment of Sales invoice No. 100 from M. Jordan minus the 1% discount.

July 15 Sold merchandise for $7000 to K. Jabbar on account. Credit terms 1/10 n/30. Sales invoice No. 101.

July 18 Borrowed $15000 cash from Pacific Bank signing a 6-month 10% note.

July 20 Sold merchandise for $12000 to J. West on account. Credit terms 1/10 n/30. Sales invoice No. 102.

July 25 Issued a credit (reduction) of $760 to J. West as an allowance for damaged merchandise previously sold on account.

July 31 Received a check from K. Jabbar for $5500 as payment on account.

Sales Journal

A specialized accounting ledger that records all sales transactions of a business, typically for goods or services on credit.

Cash Receipts Journal

A specialized accounting journal used to keep track of all cash inflows or receipts of a business.

General Journal

A comprehensive accounting ledger that records all types of financial transactions, before posting to specific accounts in the general ledger.

- Acquire knowledge on how to log and disseminate entries within unique journals.

Verified Answer

KS

Learning Objectives

- Acquire knowledge on how to log and disseminate entries within unique journals.