Asked by Connor Bowen on May 20, 2024

Verified

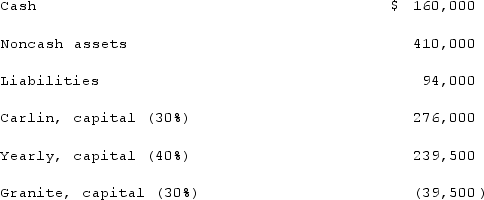

As of January 1, 2021, the partnership of Carlin, Yearly, and Granite had the following account balances and percentages for the sharing of profits and losses:  The partnership incurred losses in recent years and decided to liquidate. The liquidation expenses were expected to be $20,000.What would be the maximum amount Granite might have to contribute to the partnership to eliminate a deficit balance in his account?

The partnership incurred losses in recent years and decided to liquidate. The liquidation expenses were expected to be $20,000.What would be the maximum amount Granite might have to contribute to the partnership to eliminate a deficit balance in his account?

Deficit Balance

A financial situation where liabilities exceed assets, or expenses surpass income, leading to a negative balance.

Liquidation Expenses

Costs incurred during the process of winding up a company, selling its assets, and distributing the proceeds to claimants.

Account Balances

The amount of money in an account, representing the net difference between credits and debits in financial accounting.

- Comprehend how partners' deficit balances are handled during liquidation, along with the requirements for partners to address these shortfalls.

Verified Answer

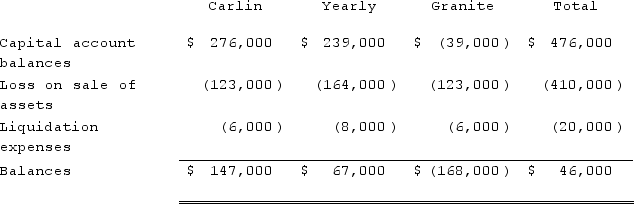

The maximum amount that Granite might have to contribute to eliminate a deficit would be $168,000, assuming that the noncash assets cannot be sold and become a total loss to the partnership.

The maximum amount that Granite might have to contribute to eliminate a deficit would be $168,000, assuming that the noncash assets cannot be sold and become a total loss to the partnership.

Learning Objectives

- Comprehend how partners' deficit balances are handled during liquidation, along with the requirements for partners to address these shortfalls.

Related questions

Hardin, Sutton, and Williams Have Operated a Local Business as ...

The Process of Winding Up the Affairs of a Partnership ...

In the Liquidating Process, Any Uncollected Cash Becomes a Loss ...

Dissolution Is the Term That Solely Means to Liquidate the ...

In a Partnership Liquidation, If a Partner Has a Debit ...