Asked by Botle Jacqueline on Jul 19, 2024

Verified

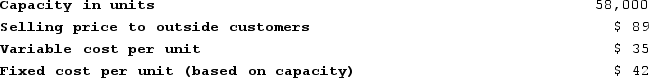

Godina Products, Incorporated, has a Receiver Division that manufactures and sells a number of products, including a standard receiver that could be used by another division in the company, the Industrial Products Division, in one of its products. Data concerning that receiver appear below:  The Industrial Products Division is currently purchasing 10,000 of these receivers per year from an overseas supplier at a cost of $81 per receiver. Assume that the Receiver Division is selling all of the receivers it can produce to outside customers. Does there exist a transfer price that would make both the Receiver and Industrial Products Division financially better off than if the Industrial Products Division were to continue buying its receivers from the outside supplier?

The Industrial Products Division is currently purchasing 10,000 of these receivers per year from an overseas supplier at a cost of $81 per receiver. Assume that the Receiver Division is selling all of the receivers it can produce to outside customers. Does there exist a transfer price that would make both the Receiver and Industrial Products Division financially better off than if the Industrial Products Division were to continue buying its receivers from the outside supplier?

A) Yes, both divisions are always better off regardless of whether the selling division has enough idle capacity to handle all of the buying division's needs.

B) Yes, the minimum transfer price that the selling division should be willing to accept is less than the maximum transfer price that the buying division should be willing to accept.

C) The answer cannot be determined from the information that has been provided.

D) No, the minimum transfer price that the selling division should be willing to accept exceeds the maximum transfer price that the buying division should be willing to accept.

Transfer Price

The price at which goods or services are transferred between departments or divisions within the same company, often used for accounting and tax purposes.

Industrial Products Division

A subsection of a company focused on the production and sale of goods used in industrial and commercial applications.

- Assess the impact of transfer pricing on both divisional profitability and the financial outcomes of the entire corporation.

Verified Answer

AB

Arnav BallaniJul 22, 2024

Final Answer :

D

Explanation :

The Receiver Division is selling all of the receivers it can produce to outside customers, which indicates that it does not have idle capacity to supply to the Industrial Products Division. Therefore, the minimum transfer price that the selling division should be willing to accept will exceed the maximum transfer price that the buying division should be willing to accept because the Receiver Division incurs opportunity costs by selling to the Industrial Products Division instead of selling to outside customers. As a result, there does not exist a transfer price that would make both divisions financially better off than if the Industrial Products Division were to continue buying its receivers from the outside supplier.

Learning Objectives

- Assess the impact of transfer pricing on both divisional profitability and the financial outcomes of the entire corporation.

Related questions

Blitch Products, Incorporated, Has a Screen Division That Manufactures and ...

The Materials Used by Hibiscus Company's Division a Are Currently ...

From the Buying Division's Perspective, When a Transferred Item Can ...

Division S of Kracker Company Makes a Part That It ...

Division S of Kracker Company Makes a Part That It ...