Asked by Kayla Kirkpatrick on Jul 30, 2024

Verified

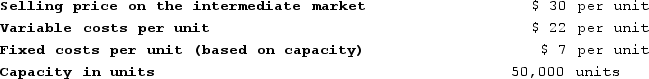

Division S of Kracker Company makes a part that it sells to other companies. Data on that part appear below:  Division B, another division of Kracker Company, presently is purchasing 10,000 units of a similar product each period from an outside supplier for $28 per unit, but would like to begin purchasing from Division S.Suppose that Division S has ample idle capacity to handle all of Division B's needs without any increase in fixed costs or cutting into sales to outside customers. If Division S refuses to accept a transfer price of $28 or less and Division B continues to buy from the outside supplier, the company as a whole will:

Division B, another division of Kracker Company, presently is purchasing 10,000 units of a similar product each period from an outside supplier for $28 per unit, but would like to begin purchasing from Division S.Suppose that Division S has ample idle capacity to handle all of Division B's needs without any increase in fixed costs or cutting into sales to outside customers. If Division S refuses to accept a transfer price of $28 or less and Division B continues to buy from the outside supplier, the company as a whole will:

A) gain $20,000 in potential profit.

B) lose $60,000 in potential profit.

C) lose $70,000 in potential profit.

D) lose $20,000 in potential profit.

Idle Capacity

The unused portion of a company's production or service capacity, where resources are available but not being fully utilized.

Potential Profit

The projected or anticipated profit from a business activity or investment, considering current or expected conditions.

Transfer Price

Transfer price refers to the price at which goods and services are sold between departments or subsidiaries within the same company.

- Evaluate the overall financial effect of transfer pricing decisions on a company's net operating income.

Verified Answer

Learning Objectives

- Evaluate the overall financial effect of transfer pricing decisions on a company's net operating income.

Related questions

Division S of Kracker Company Makes a Part That It ...

The Materials Used by Hibiscus Company's Division a Are Currently ...

Godina Products, Incorporated, Has a Receiver Division That Manufactures and ...

Blitch Products, Incorporated, Has a Screen Division That Manufactures and ...

The Objective of Transfer Pricing Is to Encourage Each Division ...