Asked by Steven McCoy on May 19, 2024

Verified

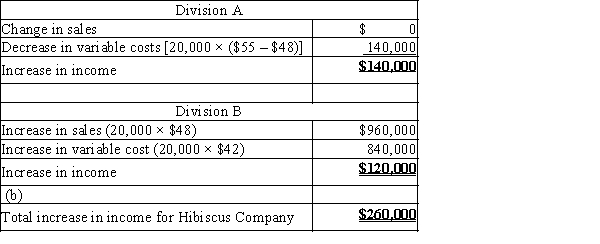

The materials used by Hibiscus Company's Division A are currently purchased from an outside supplier at $55 per unit. Division B is able to supply Division A with 20,000 units at a variable cost of $42 per unit. The two divisions have recently negotiated a transfer price of $48 per unit for the 20,000 units.

(a) By how much will each division's income increase as a result of this transfer?

(b) What is the total increase in income for Hibiscus Company?

Transfer Price

The price at which goods and services are sold between subdivisions, affiliates, or subsidiaries within the same organization.

Variable Cost

Variable costs are expenses that vary directly with the level of production or business activity, such as raw materials and direct labor.

Income Increase

Income increase refers to the rise in earnings over a period, which could be due to various factors such as revenue growth, cost reduction, or operational efficiency improvements.

- Examine the effects of transfer pricing on corporate and divisional earnings.

- Comprehend the principle and compute the residual earnings for a division.

Verified Answer

Learning Objectives

- Examine the effects of transfer pricing on corporate and divisional earnings.

- Comprehend the principle and compute the residual earnings for a division.

Related questions

Magnolia Company's Division a Has Income from Operations of $80,000 ...

Cabell Products Is a Division of a Major Corporation ...

The Consumer Products Division of Goich Corporation Had Average Operating ...

The Consumer Products Division of Goich Corporation Had Average Operating ...

The West Division of Cecchetti Corporation Had Average Operating Assets ...