Asked by Malaisha Easter on Jun 12, 2024

Verified

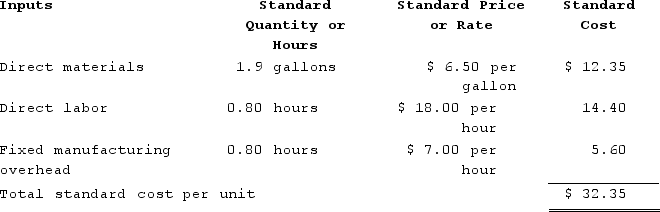

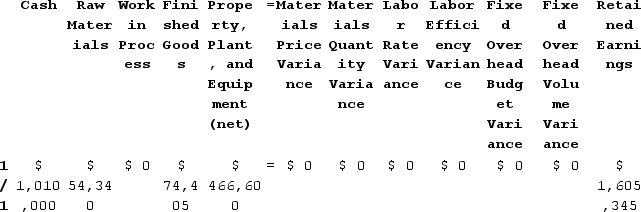

Ester Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:  The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $168,000 and budgeted activity of 24,000 hours.During the year, the company applied fixed overhead to the 22,600 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $149,800. Of this total, $83,800 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $66,000 related to depreciation of manufacturing equipment.Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $168,000 and budgeted activity of 24,000 hours.During the year, the company applied fixed overhead to the 22,600 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $149,800. Of this total, $83,800 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $66,000 related to depreciation of manufacturing equipment.Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

When applying fixed manufacturing overhead to production, the Work in Process inventory account will increase (decrease) by:

When applying fixed manufacturing overhead to production, the Work in Process inventory account will increase (decrease) by:

A) $83,800

B) ($83,800)

C) $126,560

D) ($126,560)

Fixed Overhead Budget Variance

The difference between the budgeted and actual fixed overhead costs incurred during a specified period.

Fixed Manufacturing Overhead

Costs that do not vary with the level of production, such as rent, salaries of permanent staff, and depreciation of factory equipment.

Fixed Overhead Volume Variance

The difference between the budgeted and actual fixed overhead costs attributed to the variation in produced units.

- Engage with the foundational theories and calculation tactics found in a standard cost system.

- Understand the tactics for recording transactions in a standard cost system which excludes the impact of variable manufacturing overhead.

- Acquire knowledge on implementing fixed and variable charges in the work in process inventory analysis.

Verified Answer

JR

Julissa RomeroJun 17, 2024

Final Answer :

C

Explanation :

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $168,000 and budgeted activity of 24,000 hours, resulting in the predetermined overhead rate of $7 per hour ($168,000 ÷ 24,000 hours). The actual fixed overhead costs for the year were $149,800. Of this total, $66,000 related to depreciation of manufacturing equipment, which is a noncash expense and does not affect the Work in Process inventory account. Therefore, the cash expenses related to fixed overhead are $83,800 ($149,800 - $66,000). The predetermined overhead rate of $7 per hour multiplied by the actual direct labor-hours of 18,500 hours (22,600 x 0.82) results in the applied fixed overhead of $129,500 ($7 x 18,500 hours). The difference between applied fixed overhead and actual fixed overhead is a variance that is recorded in the Cost of Goods Sold account. The variance is unfavorable because the actual fixed overhead costs exceeded the budgeted fixed overhead costs. The amount of the unfavorable variance is $19,300 ($149,800 - $129,500). Therefore, the Work in Process inventory account will increase by the applied fixed overhead of $129,500, but this increase will be partially offset by the unfavorable fixed overhead variance of $19,300, resulting in a net increase of $110,200 ($129,500 - $19,300). Adding the cash expenses related to fixed overhead of $83,800 gives a total increase in Work in Process inventory account of $194,000 ($110,200 + $83,800). Therefore, the correct answer is C, $126,560 ($194,000 - $67,440, the beginning balance of the Work in Process inventory account).

Learning Objectives

- Engage with the foundational theories and calculation tactics found in a standard cost system.

- Understand the tactics for recording transactions in a standard cost system which excludes the impact of variable manufacturing overhead.

- Acquire knowledge on implementing fixed and variable charges in the work in process inventory analysis.