Asked by Abhishek Prodduturi on Jun 16, 2024

Verified

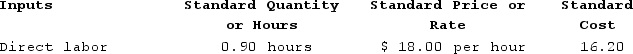

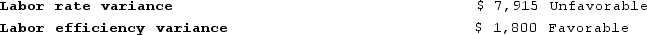

Decena Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. Information concerning the direct labor standards for the company's only product is as follows:  During the year, the company assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 15,830 hours at an average cost of $18.50 per hour. The company calculated the following direct labor variances for the year:

During the year, the company assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 15,830 hours at an average cost of $18.50 per hour. The company calculated the following direct labor variances for the year:

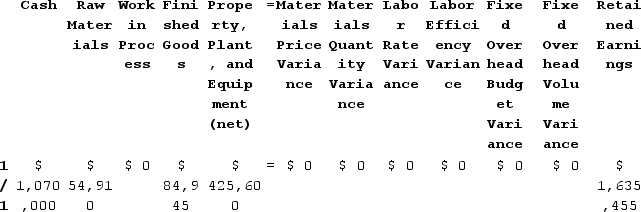

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

When recording the direct labor costs, the Cash account will increase (decrease) by:

When recording the direct labor costs, the Cash account will increase (decrease) by:

A) ($286,740)

B) ($292,855)

C) $286,740

D) $292,855

Direct Labor Variances

The differences between the budgeted and actual costs of direct labor used in production.

Direct Labor

The labor cost directly associated with the production of goods or services, including wages for workers who physically produce a product.

- Discern the procedure for transaction documentation in a standard cost framework, devoid of variable manufacturing overhead.

- Review differences in direct materials, direct labor, and manufacturing overhead expenses.

Verified Answer

GS

Gursimran SinghJun 21, 2024

Final Answer :

B

Explanation :

Direct labor costs are recorded as a debit to Work in Process and a credit to Wages Payable. Since the company paid cash for the direct labor costs, a credit entry is made to Cash for the total amount paid, which is $292,855 (15,830 hours x $18.50 per hour). Therefore, Cash increases by $292,855. The correct answer is B.

Learning Objectives

- Discern the procedure for transaction documentation in a standard cost framework, devoid of variable manufacturing overhead.

- Review differences in direct materials, direct labor, and manufacturing overhead expenses.