Asked by Shannon Forbes on Jul 28, 2024

Verified

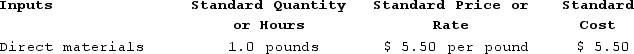

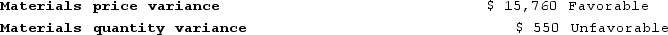

Bohon Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. There is no variable manufacturing overhead. The standard cost card for the company's only product contains the following information concerning direct materials:  During the year, the company completed the following transactions concerning direct materials:a. Purchased 19,700 pounds of raw material at a price of $4.70 per pound.b. Used 18,500 pounds of the raw material to produce 18,400 units of work in process.The company calculated the following direct materials variances for the year:

During the year, the company completed the following transactions concerning direct materials:a. Purchased 19,700 pounds of raw material at a price of $4.70 per pound.b. Used 18,500 pounds of the raw material to produce 18,400 units of work in process.The company calculated the following direct materials variances for the year:

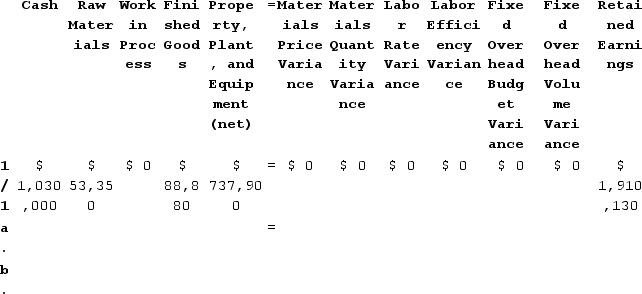

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

When recording the raw materials used in production in transaction (b) above, the Raw Materials inventory account will increase (decrease) by:

When recording the raw materials used in production in transaction (b) above, the Raw Materials inventory account will increase (decrease) by:

A) ($86,950)

B) $101,750

C) $86,950

D) ($101,750)

Materials Price Variance

The difference between the actual cost of materials used in production and the expected cost based on standard prices.

Direct Materials

Raw materials that are directly traceable to the manufacturing of a product and constitute a significant portion of the production cost.

- Get acquainted with the primary concepts and calculations involved in operating a standard cost system.

- Internalize the methodology for entering transactions in a standard cost setup, absent of variable manufacturing overhead.

- Learn about the steps for purchasing and utilizing raw materials in production activities.

Verified Answer

KK

Kainat KhaliqJul 30, 2024

Final Answer :

D

Explanation :

Since the actual cost of raw materials purchased ($92,690) is greater than the standard cost of raw materials purchased ($92,100), there is an unfavorable direct materials price variance. The amount of the unfavorable variance is calculated as follows:

Actual cost - Standard cost = Direct materials price variance

$92,690 - $92,100 = $590 unfavorable

Similarly, since the actual quantity of raw materials used (18,500 lbs) is greater than the standard quantity of raw materials allowed (18,400 lbs), there is an unfavorable direct materials quantity variance. The amount of the unfavorable variance is calculated as follows:

Actual quantity - Standard quantity = Direct materials quantity variance

18,500 lbs - 18,400 lbs = 100 lbs unfavorable

The cost of the raw materials used in production is calculated as follows:

Actual quantity x Actual cost = Actual cost of raw materials used

18,500 lbs x $4.70 = $86,950

Since the actual cost of raw materials used in production is greater than the standard cost of raw materials used in production, there is an unfavorable direct materials usage variance. The amount of the unfavorable variance is calculated as follows:

Actual cost - Standard cost = Direct materials usage variance

$86,950 - ($92,100 + $590) = $5,540 unfavorable

Therefore, the Raw Materials inventory account will decrease by the actual cost of raw materials used in production ($86,950), which is less than the standard cost of raw materials used in production, resulting in an unfavorable variance of ($5,540).

Thus, the correct answer is D, ($101,750).

Actual cost - Standard cost = Direct materials price variance

$92,690 - $92,100 = $590 unfavorable

Similarly, since the actual quantity of raw materials used (18,500 lbs) is greater than the standard quantity of raw materials allowed (18,400 lbs), there is an unfavorable direct materials quantity variance. The amount of the unfavorable variance is calculated as follows:

Actual quantity - Standard quantity = Direct materials quantity variance

18,500 lbs - 18,400 lbs = 100 lbs unfavorable

The cost of the raw materials used in production is calculated as follows:

Actual quantity x Actual cost = Actual cost of raw materials used

18,500 lbs x $4.70 = $86,950

Since the actual cost of raw materials used in production is greater than the standard cost of raw materials used in production, there is an unfavorable direct materials usage variance. The amount of the unfavorable variance is calculated as follows:

Actual cost - Standard cost = Direct materials usage variance

$86,950 - ($92,100 + $590) = $5,540 unfavorable

Therefore, the Raw Materials inventory account will decrease by the actual cost of raw materials used in production ($86,950), which is less than the standard cost of raw materials used in production, resulting in an unfavorable variance of ($5,540).

Thus, the correct answer is D, ($101,750).

Learning Objectives

- Get acquainted with the primary concepts and calculations involved in operating a standard cost system.

- Internalize the methodology for entering transactions in a standard cost setup, absent of variable manufacturing overhead.

- Learn about the steps for purchasing and utilizing raw materials in production activities.