Asked by Chris Gladden on Jun 02, 2024

Verified

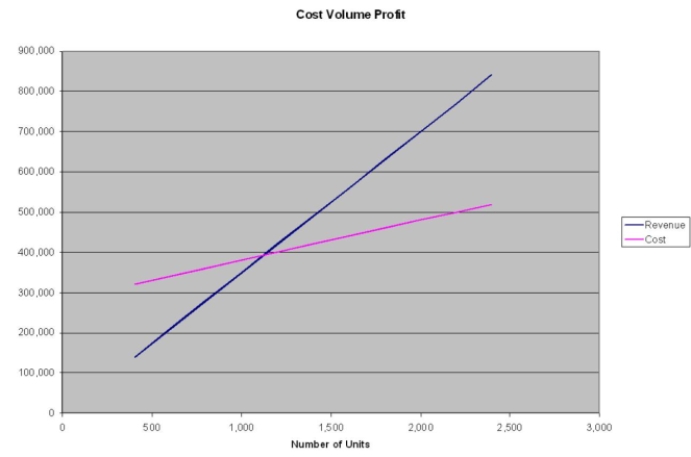

Enrique is studying the feasibility of producing a new product. His existing facilities could be expanded to manufacture 2,000 new units per month. The unit cost is $75. Estimated fixed costs are $3.36 mil per year and variable costs are $25 per unit. Competitors sell a similar product for $350 each. Use the graphical approach to CVP analysis to solve the following:

a) What would the net income be at 80% capacity?

b) What would unit sales have to be to attain a net income of $100,000?

c) If sales dropped to 60% of capacity, what would the resulting net income be?

Net Income

The amount of money left after all expenses, taxes, and deductions have been subtracted from total revenue.

CVP Analysis

Cost-Volume-Profit Analysis, a method used in managerial accounting to understand the impact of varying levels of costs and volume on operating profit.

- Use graphic means in conducting CVP analysis for the purpose of demonstrating potential profits or losses at assorted sales volume tiers.

- Calculate the volume of sales required to meet a predetermined operating income or profit.

Verified Answer

BH

Learning Objectives

- Use graphic means in conducting CVP analysis for the purpose of demonstrating potential profits or losses at assorted sales volume tiers.

- Calculate the volume of sales required to meet a predetermined operating income or profit.

Related questions

Sam Manufactures a Product That Is Selling So Well, He ...

A Manufacturing Company Is Studying the Feasibility of Producing a ...

Use the Texas Instruments BAII Plus Break-Even Worksheet to Solve ...

Use the Graphical Approach to CVP Analysis to Solve the ...

A Manufacturing Company Is Studying the Feasibility of Producing a ...