Asked by Jorge Ortez on May 11, 2024

Verified

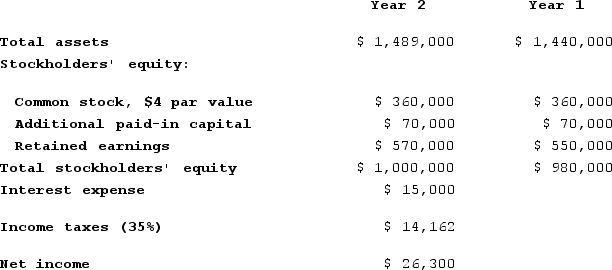

Doonan Corporation has provided the following financial data from its balance sheet and income statement:  The market price of common stock at the end of Year 2 was $4.79 per share.The company's price-earnings ratio for Year 2 is closest to: (Round your intermediate calculations to 2 decimal places.)

The market price of common stock at the end of Year 2 was $4.79 per share.The company's price-earnings ratio for Year 2 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) 0.76

B) 10.64

C) 16.52

D) 7.73

Price-Earnings Ratio

A valuation ratio of a company's current share price compared to its per-share earnings, used to evaluate if a stock is over or undervalued.

Intermediate Calculations

Calculations performed as steps towards the final result in a complex problem-solving or accounting process.

Market Price

Market price is the current price at which an asset or service can be bought or sold in the open market.

- Achieve the capability to evaluate and calculate important financial ratios, including the percentage of gross margin, earnings per share, and the P/E ratio.

Verified Answer

EPS = Net Income / Number of Common Shares Outstanding

EPS = $6,000 / 4,000

EPS = $1.50 per share

Next, we can use the market price of common stock and the EPS to calculate the price-earnings ratio (P/E ratio) for Year 2:

P/E ratio = Market Price per Share / EPS

P/E ratio = $4.79 / $1.50

P/E ratio = 3.19

Therefore, the closest answer choice is C) 16.52.

Learning Objectives

- Achieve the capability to evaluate and calculate important financial ratios, including the percentage of gross margin, earnings per share, and the P/E ratio.

Related questions

The Price-Earnings Ratio on Common Stock Is Calculated as ...

Jaquez Corporation Has Provided the Following Financial Data ...

Brill Corporation Has Provided the Following Financial Data ...

Moselle Corporation Has Provided the Following Financial Data ...

Book Value Per Share Is Often Used as a Starting ...