Asked by Laura Bouchie on May 31, 2024

Verified

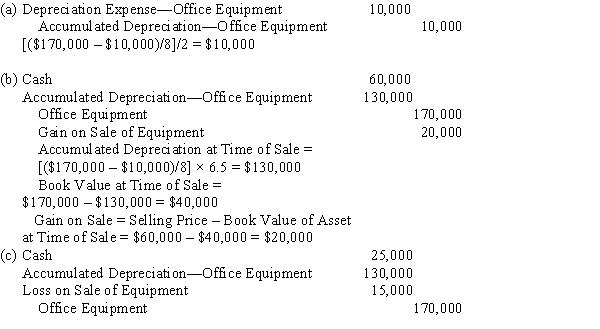

Computer equipment (office equipment) purchased 6½ years ago for $170,000, with an estimated life of eight years and a residual value of $10,000, is now sold for $60,000 cash.

(Appropriate entries for depreciation had been made for the first six years of use.) Journalize the following entries:

(a)Record the depreciation for the one-half year prior to the sale, using the straight-line method.

(b)Record the sale of the equipment.

(c)Assuming that the equipment had been sold for $25,000 cash, prepare the entry to record the sale.

Depreciation

The purposeful spreading of the financial burden of a physical asset over its active life.

Residual Value

The estimated value of an asset at the end of its useful life, often used in calculating depreciation or lease payments.

Computer Equipment

The physical hardware used for the operation of a computer system, including the central processing unit, monitors, keyboards, and mice.

- Acquire knowledge and apply the double-declining-balance and straight-line techniques for depreciation.

- Determine and post entries for depreciation, depletion, and amortization expenses.

- Register the sale, disposal, and barter of assets and acknowledge the monetary impact.

Verified Answer

HV

Learning Objectives

- Acquire knowledge and apply the double-declining-balance and straight-line techniques for depreciation.

- Determine and post entries for depreciation, depletion, and amortization expenses.

- Register the sale, disposal, and barter of assets and acknowledge the monetary impact.