Asked by Jackson Levine on May 11, 2024

Verified

A copy machine acquired with a cost of $1,410 has an estimated useful life of four years. It is also expected to have a useful operating life of 13,350 copies. Assuming that it will have a residual value of $75, determine the depreciation for the first year by the following methods:

(a)Straight-line

(b)Double-declining-balance

(c)Units-of-activity method (4,500 copies were made the first year)?

Double-Declining-Balance

A method of accelerated depreciation where an asset loses value at double the rate of its straight-line depreciation.

Units-Of-Activity

A method for allocating depreciation based on the actual usage, work, or units of production of the asset, rather than passage of time.

Residual Value

The approximate worth of an asset when it reaches the end of its usable life.

- Gain proficiency in and employ the double-declining-balance and straight-line methodologies for depreciation calculations.

- Execute calculations and make journal entries for depreciation, depletion, and amortization expenses.

- Determine and apply the units-of-activity method of depreciation.

Verified Answer

(Cost - Estimated Residual Value)/Estimated Life

Straight-Line Depreciation = ($1,410 - $75)/4

Straight-Line Depreciation = $333.75 per year

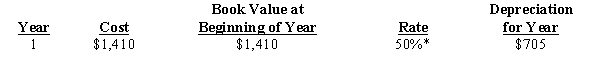

(b) Double-Declining-Balance = $705, determined as follows:?

*Rate =

*Rate = (100%/Life) × 2Rate = 1/4 × 2Rate = 0.50?

(c)Units-of-Activity =

(Cost - Estimated Residual Value)/Estimated CopiesUnits-of-Activity =

($1,410 - $75)/13,350Units-of-Activity = $0.10 per copy?First-Year Depreciation = $450

($0.10 × 4,500)?

Learning Objectives

- Gain proficiency in and employ the double-declining-balance and straight-line methodologies for depreciation calculations.

- Execute calculations and make journal entries for depreciation, depletion, and amortization expenses.

- Determine and apply the units-of-activity method of depreciation.

Related questions

On December 31, It Was Estimated That Goodwill of $65,000 ...

Computer Equipment (Office Equipment) Purchased 6½ Years Ago for ...

On July 1, Andrew Company Purchased Equipment at a Cost ...

On December 31, Bowman Company Estimated That Goodwill of $80,000 ...

Dougan Company Purchased Equipment on January 1 2016 for $90000 ...