Asked by Michael McGuire on Jun 25, 2024

Verified

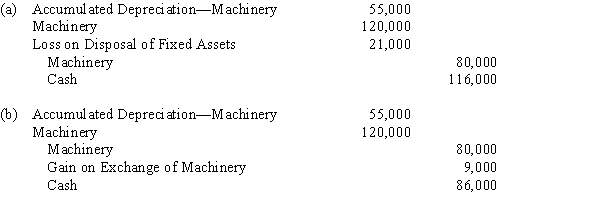

Machinery acquired at a cost of $80,000 and on which there is accumulated depreciation of $55,000

(including depreciation for the current year to date) is exchanged for similar machinery. Assume that the transaction has commercial substance. For financial reporting purposes, present entries to record the exchange of the machinery under each of the following assumptions:

(a)Price of new, $120,000; trade-in allowance on old, $4,000; balance paid in cash.

(b)Price of new, $120,000; trade-in allowance on old, $34,000; balance paid in cash.

Accumulated Depreciation

The total amount of depreciation expensed over an asset's useful life, reducing its book value on the balance sheet.

Commercial Substance

A concept in accounting that indicates a transaction has caused a significant change in future cash flows.

Trade-In Allowance

The value credited to the purchaser when they trade in a used item towards the purchase of a new item.

- Note the transaction, discard, and exchange of assets and perceive the financial implications.

Verified Answer

PB

Learning Objectives

- Note the transaction, discard, and exchange of assets and perceive the financial implications.