Asked by Benjamin Cohen on May 22, 2024

Verified

A partial standard cost card for the single product produced by Mercer Company is given below:

Direct materials: 3 pounds @ $8 per pound

Direct labor: ? hours @ ? per hour

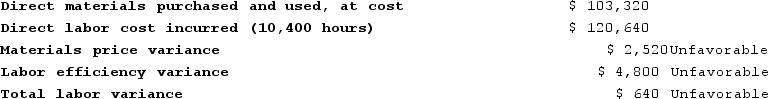

Last period the company produced 4,000 units of product. Cost and other data associated with this production are given below:

The direct materials purchases variance is computed when the materials are purchased.

The direct materials purchases variance is computed when the materials are purchased.

Required:

a. Determine the number of pounds of direct materials purchased and used during the period.

b. Determine the materials quantity variance.

c. Determine the standard direct labor rate per direct labor hour.

d. Determine the standard hours allowed for the production of the period.

Materials Quantity Variance

The variance between the real amount of materials consumed in the manufacturing process and the anticipated standard amount, measured at the standard expense.

- Inspect and clarify the variances found in material costs and volumes.

- Work out and deduce the nuances in direct labor rate and efficiency variances.

Verified Answer

SD

Srishty DagarMay 22, 2024

Final Answer :

a. Materials price variance = (Actual quantity × Actual price) − (Actual quantity × Standard price)

$2,520 Favorable = $103,320 − (Actual quantity × $8 per pound)

$2,520 = $103,320 − (Actual quantity × $8 per pound)

Actual quantity × $8 per pound = $103,320 − $2,520

Actual quantity × $8 per pound = $100,800

Actual quantity = $100,800 ÷ $8 per pound = 12,600 pounds

b. Materials quantity variance = (Actual quantity − Standard quantity) × Standard price

= (12,600 pounds − 12,000 pounds*) × $8 per pound

= (600 pounds) × $8 per pound

= $4,800 Unfavorable

*4,000 units × 3 pounds per unit = 12,000 pounds

c. If the total labor variance is $640 Unfavorable, and if the labor efficiency variance is $4,800 Unfavorable, then the labor rate variance must be $4,160 Favorable. Therefore:Labor rate variance = Actual hours × (Actual rate − Standard rate)

$4,160 Favorable = 10,400 hours × ($11.60 per hour* − Standard rate)

−$4,160 = 10,400 hours × ($11.60 per hour* − Standard rate)

−$4,160 = $120,640 − 10,400 hours × Standard rate

10,400 hours × Standard rate = $120,640 + $4,160

10,400 hours × Standard rate = $124,800

Standard rate = $124,800 ÷ 10,400 hours

Standard rate = $12 per hour

d. Labor efficiency variance = (Actual hours − Standard hours) × Standard rate

$4,800 Unfavorable = (10,400 hours − Standard hours) × $12 per hour

$4,800 = (10,400 hours − Standard hours) × $12 per hour

$4,800 = $124,800 − Standard hours × $12 per hour

Standard hours × $12 per hour = $124,800 − $4,800

Standard hours × $12 per hour = $120,000

Standard hours = $120,000 ÷ $12 per hour

Standard hours = 10,000 hours

$2,520 Favorable = $103,320 − (Actual quantity × $8 per pound)

$2,520 = $103,320 − (Actual quantity × $8 per pound)

Actual quantity × $8 per pound = $103,320 − $2,520

Actual quantity × $8 per pound = $100,800

Actual quantity = $100,800 ÷ $8 per pound = 12,600 pounds

b. Materials quantity variance = (Actual quantity − Standard quantity) × Standard price

= (12,600 pounds − 12,000 pounds*) × $8 per pound

= (600 pounds) × $8 per pound

= $4,800 Unfavorable

*4,000 units × 3 pounds per unit = 12,000 pounds

c. If the total labor variance is $640 Unfavorable, and if the labor efficiency variance is $4,800 Unfavorable, then the labor rate variance must be $4,160 Favorable. Therefore:Labor rate variance = Actual hours × (Actual rate − Standard rate)

$4,160 Favorable = 10,400 hours × ($11.60 per hour* − Standard rate)

−$4,160 = 10,400 hours × ($11.60 per hour* − Standard rate)

−$4,160 = $120,640 − 10,400 hours × Standard rate

10,400 hours × Standard rate = $120,640 + $4,160

10,400 hours × Standard rate = $124,800

Standard rate = $124,800 ÷ 10,400 hours

Standard rate = $12 per hour

d. Labor efficiency variance = (Actual hours − Standard hours) × Standard rate

$4,800 Unfavorable = (10,400 hours − Standard hours) × $12 per hour

$4,800 = (10,400 hours − Standard hours) × $12 per hour

$4,800 = $124,800 − Standard hours × $12 per hour

Standard hours × $12 per hour = $124,800 − $4,800

Standard hours × $12 per hour = $120,000

Standard hours = $120,000 ÷ $12 per hour

Standard hours = 10,000 hours

Learning Objectives

- Inspect and clarify the variances found in material costs and volumes.

- Work out and deduce the nuances in direct labor rate and efficiency variances.

Related questions

Klacic Corporation Makes a Product with the Following Standard Costs ...

Lido Company's Standard and Actual Costs Per Unit for the ...

The Following Labor Standards Have Been Established for a Particular ...

Kropf Incorporated Has Provided the Following Data Concerning One of ...

Camps Incorporated Has a Standard Cost System ...