Asked by Brandon McMahon on May 12, 2024

Verified

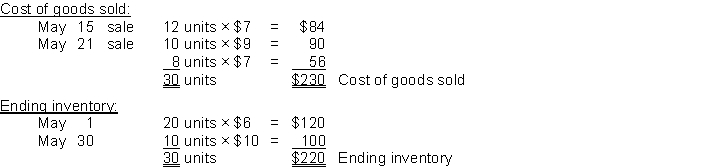

Britt Company uses the perpetual inventory system and the LIFO method. The following information is available for the month of May: May 1 Beginning inventory 20 units @$610 Purchase 20 units @$715 Sales 12 units 18 Purchase 10 units @$921 Sales 18 units 30 Purchase 10 units @$10\begin{array} { r l l } \text { May } 1 & \text { Beginning inventory } & 20 \text { units } @\$ 6 \\10 & \text { Purchase } & 20 \text { units } @ \$ 7 \\15 & \text { Sales } & 12 \text { units } \\18 & \text { Purchase } & 10 \text { units }@ \$ 9 \\21 & \text { Sales } & 18 \text { units } \\30 & \text { Purchase } & 10 \text { units } @ \$ 10\end{array} May 11015182130 Beginning inventory Purchase Sales Purchase Sales Purchase 20 units @$620 units @$712 units 10 units @$918 units 10 units @$10 Instructions

Prepare a schedule to show cost of goods sold and the value of the ending inventory for the month of May.

Perpetual Inventory System

An inventory management system that continuously updates the quantity and value of inventory on hand after each transaction.

LIFO Method

"Last In, First Out," an inventory costing method where the last items placed in inventory are the first ones to be used or sold.

Schedule

A schedule is a detailed plan that outlines specific activities or tasks along with their intended start and finish times, designed to achieve an objective.

- Compute cost of goods sold and ending inventory under different inventory systems and costing methods.

Verified Answer

AS

Learning Objectives

- Compute cost of goods sold and ending inventory under different inventory systems and costing methods.